Reaching for Yield: Short-Term Gains, Longer-Term Pains?

by Gavin L. Miller, CFA, Supervisory Financial Analyst, Board of Governors

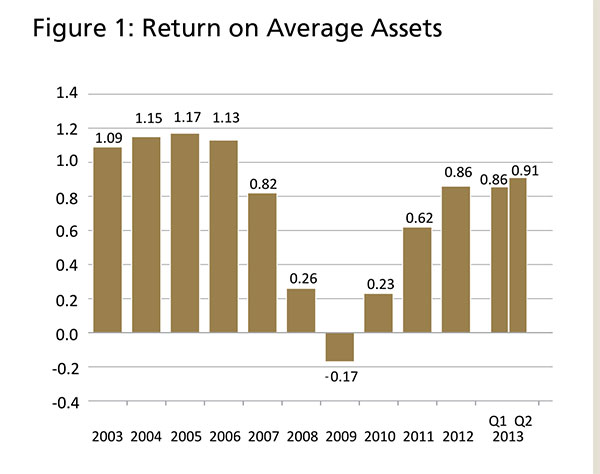

Bank earnings are back! For smaller community state member banks (CSMBs), defined as those with total consolidated assets less than $1 billion, second quarter 2013 aggregate return on average assets (ROAA) reached an annualized rate of 0.91 percent, a significant improvement over the rate achieved during the depths of the financial crisis when full-year 2009 results were ‑0.17 percent. For the same period, aggregate return on equity (ROE) rose from ‑1.7 percent to 8.5 percent.

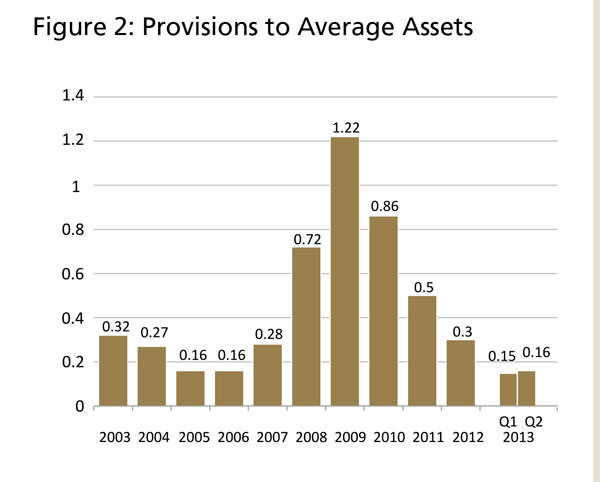

Is the earnings environment really that good? The evidence suggests a need for caution. As illustrated in Figures 1 and 2, the crisis period decline and postcrisis rise of bank ROAA nearly mirrors the inverse of provisioning. So, while declining provisions recently boosted ROAA results, further enhancements are unlikely. Also, though earnings have improved, ROAA and ROE remain well below precrisis levels (between 2002 and 2006, CSMBs' ROAA and ROE averaged 1.14 percent and 11.41 percent, respectively).

A significant hurdle for smaller community bank earnings is compressed net interest margins. Since 2011, bank asset yields have declined faster than liability yields, causing reduced profitability on an asset base already struggling to remain at current levels.

Current Earnings Environment Encourages Reaching for Yield

Given this difficult earnings environment, it is easy to understand why bankers might consider — and regulators might be concerned about — activities that "reach for yield." Put simply, reaching for yield is any activity that board members and management typically consider more risky (beyond the bank's risk tolerance) but nevertheless have undertaken as a means to improve short-term earnings. Examples might include lowering loan and investment credit quality standards, increasing loan and investment durations, purchasing structured investments, leveraging investments, and pursuing novel loan and deposit products.

Of course, these actions might be appropriate in some contexts, but if board members and management change policies and procedures to accommodate new activities and ways of doing business, they should also recognize that they are increasing the bank's risk tolerance.

Most recently, it appears that some CSMBs are taking additional risk in their investment portfolios, mostly through extended investment duration but also through more structured products and corporate credits.

As community banks refine their business strategies for the postcrisis environment, they should be mindful of the long-term risk/reward trade-offs on their balance sheets.

Longer-Term Cost of Reaching for Yield Can Be Significant

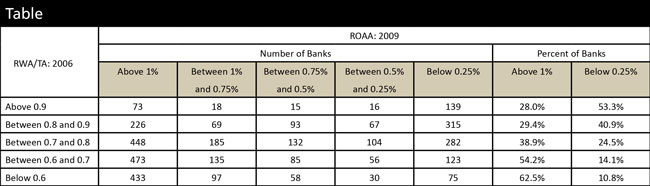

To that end, and building on the earlier analysis of earnings at smaller CSMBs, staff at the Board of Governors of the Federal Reserve System recently gathered data for top earnings performers in 2006 and evaluated whether or not the riskiness of their precrisis assets could predict future earnings performance in a downturn (2009). In short, the answer was yes.

The analysis used a wider sample that included all community banks (those with less than $10 billion in total consolidated assets) that reported a 1 percent or better ROAA in 2006. For each bank, the ratio of risk-weighted assets to total assets (RWA/TA) serves as a proxy for precrisis credit risk; a higher ratio suggests riskier assets. Banks were then segmented by their 2006 RWA/TA credit risk ratio and their 2009 ROAA performance, as seen in the table below.

The good news is that many community banks with healthy 2006 earnings maintained that performance throughout the crisis. For example, roughly 60 percent of banks with an RWA/TA ratio below 0.7 in 2006 earned an ROAA of 1 percent or better in 2009. Notably, those were the less risky banks among those with strong earnings in 2006.

But, when we look at the higher-risk banks (those with a 2006 RWA/TA ratio above 0.8), the story reverses: Only 29 percent of riskier banks in 2006 maintained a 1 percent or better ROAA in 2009. Unfortunately, the earnings performance of many of those banks not only slipped but also significantly faltered: Roughly half of them earned an ROAA below 0.25 percent in 2009.

To be sure, the measurement of balance sheet credit risk in this analysis is basic, and there are other indicators of financial performance other than ROAA. Moreover, this analysis does not consider how banks' balance sheets might have shifted between 2006 and 2009, nor does it consider the much weaker earnings environment in 2009.

Do the results mean that banks should not consider taking more risk and reaching for yield? Not necessarily. Clearly, some banks maintained healthy performance, but, and perhaps more important, most did not. The analysis does not indicate whether or not the reward for higher risk was achieved over a longer period of time. What has been demonstrated over time, however, is that taking too much risk and having too little capital can put a bank out of business before the long term fully materializes. That is, if a bank is going to hold higher-risk assets, it must have the financial wherewithal to hold them in both good and bad times.

Things to Consider Before Reaching for Yield

Given the current earnings environment and this brief earnings risk analysis, community banks should consider several questions before reaching for yield.

- What are the bank's historical risk-adjusted returns on its assets? It is difficult for a portfolio manager to allocate capital well without knowing the risk/reward trade-off of possible investment opportunities. Similarly, it is difficult for a banker to choose business activities and investments without similar data. One aid is to calculate a simplified business cycle return on capital for each asset class. By adjusting the returns of each asset class for its risk, bankers can create yields that are directly comparable and that may highlight clear winners and losers.

- Is the bank distributing earnings that should be retained for unexpected losses? If there are good reasons for the bank to lend in higher-risk asset categories, it may be a good bet. However, it might also be prudent to retain more bank earnings over the economic cycle to ensure that the bank can absorb more than industry-typical losses in tough times. Management does not want to determine in hindsight that the bank distributed income it should have retained for loss absorption.

- What are the ROE requirements of the bank's particular investors? Many community banks have small, closely held investor bases. Though these investors — like all investors — want reasonable risk-adjusted returns on capital, some may be willing to take a less generous return given the bank's important role in the community.

Conclusion

Tough times frequently challenge a banking organization's plans and habits. After careful analysis of the current difficult earnings conditions, management may decide to make strategic and/or tactical changes. However, it is important to differentiate between these types of changes to ensure that a reasonable tactical decision does not unintentionally become a problematic strategic one. If a tactical shift — such as reaching for yield — makes sense for a community bank, management should also protect the bank against potential longer-term troubles by ensuring that there are meaningful limits, appropriate capital-to-risk allocations, and knowledgeable and timely oversight to keep the activities within the bounds of safe and sound banking operations.

The author would like to thank Padraic Glackin, Financial Analyst, Board of Governors, for his collection of the earnings data in this article.