Improved Risk Identification Helps Tailor Examinations to Banks' Risk Levels

by Vadim Bondarenko, Senior Data Scientist, Federal Reserve Board of Governors; Chris Henderson, Assistant Vice President, Federal Reserve Bank of Philadelphia; and Matthew Nankivel, Managing Director, Federal Reserve Bank of Minneapolis

The Bank Exams Tailored to Risk (BETR) program is the Federal Reserve’s new approach to tailoring supervision of community and regional banks.1 The BETR program was adopted in June 2019 and is responsive to Congress’s call to enhance tailoring of supervisory programs.2 Although risk focusing is a long-standing practice for bank supervisors, BETR enhances this practice by taking a rigorous and structured approach to combining data analytics and examiner judgment to plan the scope of bank examinations.

The BETR program is structured around the most important risks faced by a bank (e.g., credit, liquidity, and earnings risks). For each risk dimension, the BETR program combines a rigorous data-driven approach to measuring a bank’s risk, examination procedures appropriately tailored to the level of risk, and an examination staffing process for aligning supervisory resources to risk. The BETR program provides several benefits, including:

- improved risk identification and measurement processes that allow the Federal Reserve to apply more streamlined examination work programs to state member banks (SMBs) with lower risk profiles. This helps reduce the burden on banks with lower-risk activities by expending fewer hours on the examination; it also enhances the Federal Reserve’s ability to target high-risk activities that need elevated supervisory attention at SMBs.

- standardized work programs in alignment with risk, which promote consistent examinations and the balanced treatments of SMBs.

- an improvement in ongoing risk monitoring between examinations. Specifically, BETR helps identify early signs of increased risk-taking, both at individual SMBs and across the banking industry.

What aspects of supervision does BETR not include? BETR is an examination scoping tool, but it does not replace the examination process itself or contribute directly to supervisory ratings. In addition, BETR is not a substitute for supervisory judgment or a replacement for examiner discretion. Finally, although BETR seeks to identify banks with higher chances of adverse performance, it does not predict a bank’s viability.

This article builds on the information contained in SR letter 19-9, “Bank Exams Tailored to Risk (BETR).” It discusses the development of BETR’s surveillance metrics, explains the process of tailoring examination procedures to risk, and presents aggregate risk classification results for small commercial banks.

BETR’s Surveillance Metrics

Data analytics is an increasingly important component of bank supervision. To this end, BETR uses surveillance metrics that help identify and measure the risks faced by community and regional SMBs. Federal Reserve supervisory staff are directed to collect, analyze, evaluate, and act on risk information that is available from Call Reports, supervisory findings, and other information sources. The role of data analytics is to help select — from the large quantity of data available to supervisors — those data elements that, when optimally combined, provide the most forward-looking and reliable risk signals.

In the BETR program, data analytics generates a set of risk indicators that result in a risk classification, or risk tier, of low, moderate, or high for each type of risk considered. Supervisory staff combine a variety of risk indicators into a single measure estimating the likelihood of an adverse performance outcome, such as a highly unfavorable financial trend, significant performance shortfall, severe loss, or supervisory rating downgrade, typically over a 12- to 24-month time frame, under unfavorable market conditions. A risk tier of high applies to activities that, under unfavorable market conditions, often lead to adverse outcomes. At the other end of the risk spectrum, for low-risk activities, the expected incidence of adverse outcomes is low, irrespective of market conditions.

Examiners can change the risk tier when they are aware of factors outside the BETR metrics, and there is a system in place to review all overrides. For example, an examiner might increase the risk tier because the bank is planning a significant strategy change or key management turnover. Examiners also have the ability to decrease the risk tier, such as when risk associated with an agricultural portfolio is partially mitigated by well-administered government guarantees.

Risk tailoring can enhance bank supervision by integrating forward-looking risk metrics that allow examination procedures to be calibrated to the risk profile of an institution. Currently, the BETR program uses such surveillance metrics for the following examination areas: capital, credit, earnings, liquidity, interest rate risk, and investment securities. Figure 1 provides an example of the types of data elements that examiners have found useful in assessing credit risk. Some of the risk indicators pertain to current loan performance, while others reflect a bank’s credit exposure or business strategy. A bank’s current performance and its forward-looking risk posture can both play important roles in assessing risk and planning the scope of examination work.

Figure 1: Examples of Potential Credit Risk Indicators*

Credit Concentration

- Agricultural loans

- Commercial and industrial loans

- Commercial real estate loans

- Construction and land development loans

- Combined loan concentrations

Banking Strategy

- High loan growth indicator

- Noncore funding dependence

Loan Performance

- Loans 30–89 days past due

- Loans 90 or more days past due

- Net loan charge-offs

*The list of potential risk indicators shown here is for illustration purposes only. The specific risk indicators used and the manner of their combinations into risk tiers can change over time.

The BETR model allows examination staff to assign probabilities to future adverse credit outcomes, which, in turn, helps direct more resources to institutions with higher risk activities. An example of a possible adverse credit outcome would be a bank that has a so-called Texas ratio in the worst 10 percent of all commercial banks in a given quarter. These metrics become more critical as the U.S. economy moves toward turning points in the cycle and the number of problem banks begins to rise or fall.3

The U.S. economy is in a record expansion following its previous trough in the second quarter of 2009. Participants in the financial press, regulatory briefings, and academic publications have noted an increasing number of potential banking risks. BETR’s surveillance program produces forward-looking metrics that could help supervisory staff look beyond current conditions to identify and address risks that could be present or may be building.

Risk-Aligned Examination Work Programs

The primary goals of the BETR program are to create standardized, risk-aligned work programs for examiners to promote appropriate differentiation in the scope of work across risk tiers and to ensure a consistent supervisory program. The more accurately surveillance metrics are able to assess risk, the more appropriately examiners can differentiate examination work programs across risk tiers. In other words, more robust risk measurement enables greater reduction in examination scope and possible burden for banks with designated low-risk activities.

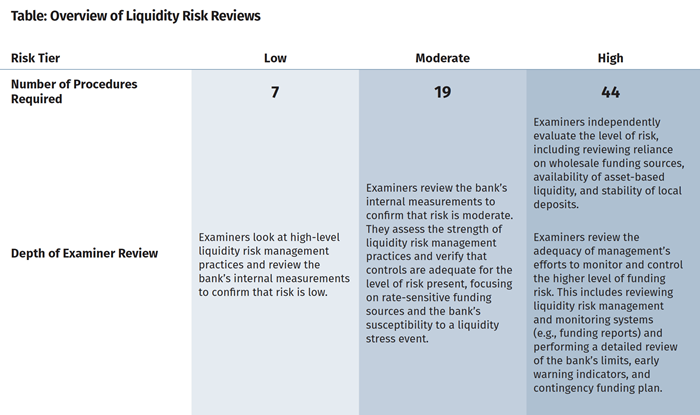

The specific manner of risk tailoring of examination processes proceeds along two dimensions. First, low- or moderate‑risk work programs are shorter and cover fewer topics than high-risk work programs. Second, examiners adjust the depth of review to reflect a bank’s risk level. In practice, this means that for banks with high-risk activities, examiners apply the full extent of examination procedures and conduct additional work as necessary, including independent verification and transaction testing. At banks with activities classified as moderate risk, examiners apply a subset of examination procedures, with a focus on evaluating an SMB’s key risk drivers, and limit independent verification and transaction testing to specific areas. Finally, when reviewing banks with low-risk activities, examiners apply a smaller subset of examination procedures, and transaction testing is reduced further.

As shown in the Table, the number of required examination procedures for liquidity risk aligns with the designated risk tier. Similar risk tailoring occurs for the other risk dimensions covered by the BETR program. As a result, banks with low-risk activities should experience shorter examinations, while banks engaged in higher-risk activities are subject to more intense supervisory focus.

Aggregate Risk-Tiering Results

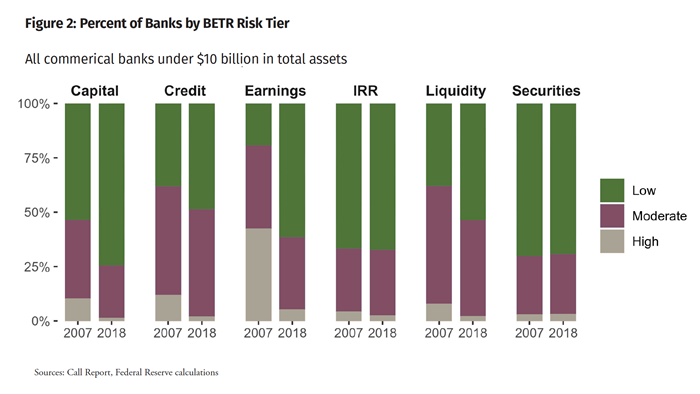

As banks’ strategies and actions result in evolving risk profiles, the BETR program’s risk indicators capture such movements, which can lead to changes in risk tiers. Figure 2 shows that, for capital, credit, earnings, and liquidity, the share of small banks classified as high- or moderate-risk was notably greater at the start of the last recession than more recently, indicating a moderation in bank risk profiles over time.4

These risk-tier distribution results point to the relatively high degree of risk embedded in the banks before the recession, with small banks now generally better positioned to handle unfavorable market conditions.

The results for earnings risk in 2007 and 2018 illustrate some of the benefits of the BETR risk-tiering methodology by providing a more forward-looking view. A basic point-in-time indicator for bank earnings, the return on average assets (ROAA), was fairly strong in both periods, with a year-end median of about 1.1 percent for 2007 and 2018.5 However, there were more cases of high earnings risk in 2007, as captured by BETR and risk indicators such as high interest expense relative to peers and high noninterest expense compared with revenue.

The Future of the BETR Program

The BETR program’s risk classification and examination procedures are currently in use for capital, credit, earnings, liquidity, interest rate, and securities risks. The Federal Reserve is also developing risk metrics and examination procedures in the BETR program to address nonfinancial risks, such as those covered in Bank Secrecy Act/Anti-Money Laundering reviews. As the program continues to evolve, metrics and procedures for additional risk dimensions are in development and will be deployed as work is completed. The Federal Reserve is also committed to continuously reviewing metrics and procedures to ensure accuracy. This allows the Federal Reserve not only to continue to risk-tailor examinations but also to further improve examination processes. The BETR program puts the Federal Reserve in a stronger position to gauge the risks within a bank’s activities, align examination procedures with risk levels, and monitor risk between examinations.

- 1 The BETR program applies to community and regional state member banks and is detailed in Supervision and Regulation (SR) letter 19-9, available at www.federalreserve.gov/supervisionreg/srletters/sr1909.htm.

- 2 See the Board of Governors’ statement about the Economic Growth, Regulatory Relief, and Consumer Protection Act (EGRRCPA) at www.federalreserve.gov/newsevents/pressreleases/bcreg20180706b.htm.

- 3 A basic Texas ratio is defined as the value of nonperforming loans plus other real estate owned divided by the sum of tangible equity capital and the allowance for loan and lease losses.

- 4 The 2007 risk tiers presented in Figure 2 were created using historical data in current metrics; however, BETR’s risk metrics were not available during the last recession.

- 5 This is calculated as the median ROAA for all commercial banks with less than $10 billion in assets.