Interest Rate Risk Management at Community Banks

by Doug Gray, Managing Examiner, Federal Reserve Bank of Kansas City

Over the past few years, the banking industry has faced significant earnings challenges. Community bank profitability has been under pressure due to increases in nonaccrual loans, credit losses, other-than-temporary impairment (OTTI) charges, and loan workout expenses. Many banks have responded to these earnings challenges by “tightening their belts,” but, understandably, cost-cutting measures can go only so far for community banks that are committed to meeting the needs of local families and businesses with a level of service that differentiates them from larger banking organizations.

To meet the challenge of generating positive earnings and more suitable returns for their stakeholders, many banks have lengthened asset maturities or increased assets with embedded optionality. These actions serve to increase interest rate risk exposures and, thus, the need for more robust risk management programs. The purpose of this article is to provide an overview of the current banking landscape and to discuss key interest rate risk management activities and concepts for community banks. More detailed discussions of specific interest rate risk management elements are planned for subsequent articles.

The Current Landscape

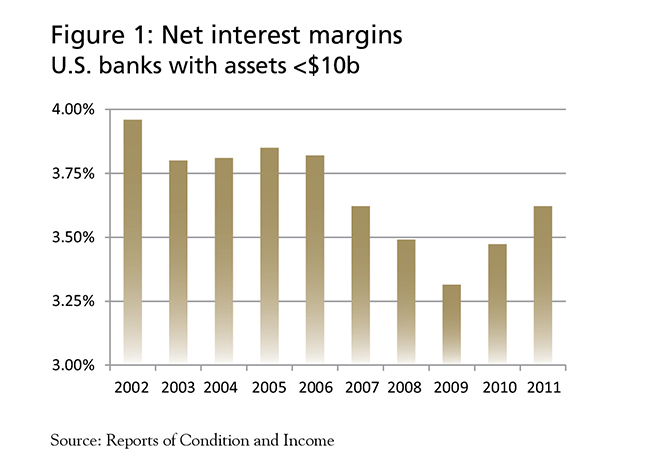

During the credit downturn, problem loan losses and accompanying provision expenses were the most significant contributors to net losses at community banks. Lying further beneath the surface of these net losses was significant contraction of net interest margins. While net interest margins have begun to improve following reductions of nonperforming assets and repricing of term deposits at today’s lower rates, margins continue to lag levels achieved in the past decade, as illustrated in Figure 1.

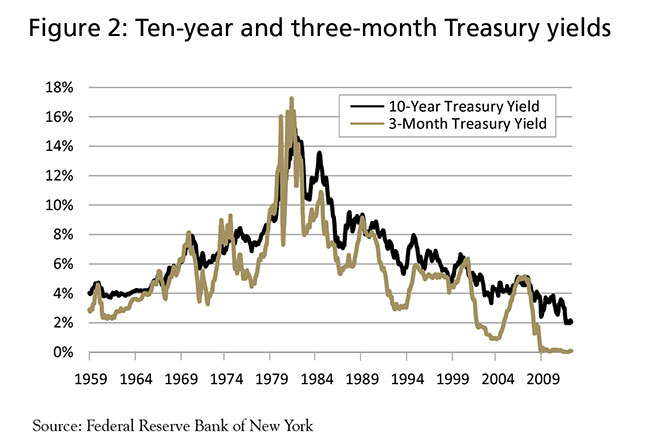

By historical standards, interest rates across the maturity spectrum are low and have been for some time, as illustrated by the depiction of short- and long-term Treasury rates in Figure 2.

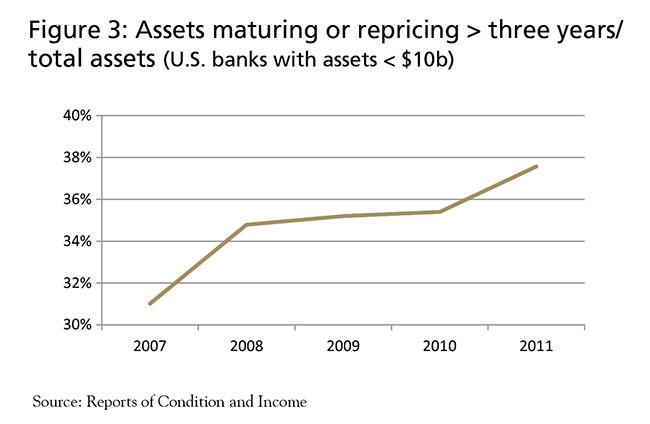

Low interest rates, coupled with business contraction, have created an environment where bankers face difficult choices to maintain earnings performance. Some have elected to pursue new business lines that generate different sources of interest income or additional noninterest income, although these business lines may create new operational, credit, liquidity, and legal risks to those firms. Others have chosen to extend asset maturities and/or increase holdings of bonds with embedded options, thereby widening spreads but taking on greater interest rate risk. This trend is illustrated by the increase in assets with maturities or repricing terms greater than three years as a percentage of total assets (Figure 3).

Those institutions extending asset maturities without a corresponding shift in liabilities are particularly exposed to significant upward movements in interest rates, which is not as uncommon as often perceived. In fact, the overnight federal funds rate experienced a change of 300 basis points or more over a 12-month period 15 percent of the time between 1955 and 2008.1 It was in response to the pressure banks faced to generate earnings and increase assets with longer maturities, while also shortening their liability maturities, that financial institution regulators issued an Interagency Advisory on Interest Rate Risk (interagency advisory) in 2010 and, earlier this year, a follow-up document, Interagency Advisory on Interest Rate Risk Management: Frequently Asked Questions (FAQs).2 The interagency advisory and FAQs are applicable to banks of all sizes and complexities.

Common Interest Rate Risk Exposures

Generally speaking, interest rate risk is the risk that an adverse outcome will result from changes in interest rates. While interest rate risk can arise from various sources, four key types of interest rate risk are common to community bank balance sheets:

- Mismatch/Repricing Risk: The risk that assets and liabilities reprice or mature at different times, causing margins between interest income and interest expense to narrow.

- Basis Risk: The risk that changes in underlying index rates used to price assets and liabilities do not change in a correlated manner, causing margins to narrow. For example, loans priced off national prime rates might not change in the same manner as certificates of deposit priced off U.S. Treasury rates.

- Prepayment/Extension Risks: The risk that asset repayments accelerate at a time when interest rates are low, resulting in diminished interest income and the need to reinvest repaid funds in lower-yielding assets. This risk intensifies when loan customers or bond issuers exercise their explicit call options to pay off the bank’s asset prior to maturity and interest rates decline. The flip side of prepayment risk is extension risk, which stems from the lengthening of asset payoff rates in a rising rate environment, thereby reducing the funds available to invest at higher yields.

- Yield Curve Risk: The risk that nonparallel changes in the yield curve will disproportionately affect asset values or cash flows. For example, mortgage assets tend to be priced off 10-year U.S. Treasury rates. Suppose 10-year Treasury rates change significantly, while all other Treasury rates remain unchanged. The value and cash flows from mortgage loans and mortgage-related securities will also change significantly, but other assets and liabilities will not experience similar changes. Thus, banks with significant mortgage asset holdings would be exposed to greater yield curve risk than those with mortgage assets comprising a lower percentage of assets.

Key Risk Management Elements

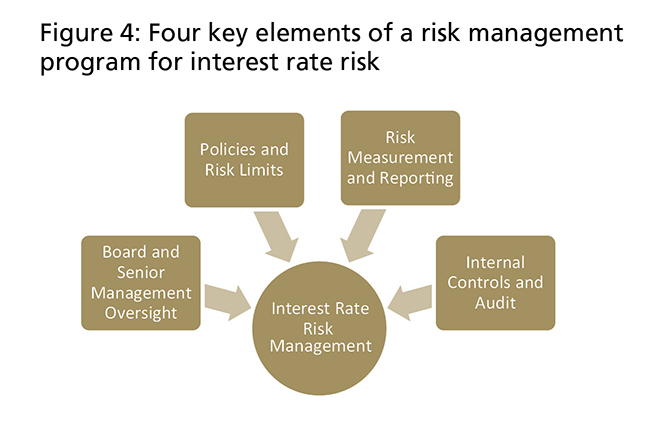

Because banks are in the business of transforming short-term deposits into longer-term loans, they are inherently exposed to some degree of interest rate risk. Those exposures warrant risk management programs that allow the bank’s management team and board of directors to appropriately identify, measure, monitor, and control these exposures. The rigor and expense applied to these programs should be commensurate with the size of the risk exposures and complexity of activities and holdings. Therefore, while there are elements of interest rate risk management that all banks should have in place, community banks would not necessarily need the same level of sophistication in their risk management practices as those that are in use at larger, more complex banking organizations. Figure 4 illustrates four key elements that are fundamental to every bank’s interest rate risk management program:

Board and Senior Management Oversight

A bank’s board of directors is ultimately responsible for setting the institution’s risk tolerance/appetite and overseeing the establishment of appropriate risk controls, both of which affect the level of interest rate risk exposure at the bank. While many community bank directors may have limited involvement with interest rate risk management in their own professional careers outside the institution, a bank’s board is expected to have a collective fundamental working knowledge of the different types of interest rate risk, how business activities could create or change the bank’s exposure, and how risk measurement reports can be used to identify exposures. In the past 15 years, significant progress has been made in the banking industry to develop interest rate risk and other training materials for directors, an example of which is the Federal Reserve System’s Bank Director’s Desktop.3

With this knowledge, directors can establish policies, risk limits, and management governance structures that foster appropriate oversight of interest rate risk. Often, community bank boards charge management committees, or even board committees, such as an Asset/Liability Management Committee (ALCO), with risk measurement and monitoring responsibilities. When bank examiners evaluate board and senior management oversight, they assess the degree to which the board supports risk management activities by funding appropriate risk measurement tools and staff, establishing appropriate risk exposure limits (discussed below), and holding the ALCO accountable for implementing the board’s guidance.

Policies and Risk Limits

Effective communication of the board’s intentions regarding interest rate risk taking and risk management is important and should be accomplished through policies that are reviewed and updated periodically. Interest rate risk policies can be standalone documents or housed in a broader asset/liability management policy. At a minimum, board policies should describe the bank’s risk tolerance/appetite; methods to identify, quantify, and report exposures; parties responsible for ongoing risk measurement and management; and the controls and risk limits necessary to ensure that the risk management function is operating appropriately. When bank examiners evaluate interest rate risk policies, these are the key components considered.

Perhaps the most significant component of a sound interest rate risk policy is the establishment of appropriate risk limits. Risk limits convey to staff how much exposure is acceptable before remedial actions should be taken to address an excessive risk position. Moreover, risk limits should reflect manageable constraints that are not excessively broad so that they provide a meaningful control.

For any risk limit to be useful, it must be understood by management and the board; be capable of being measured with existing risk measurement tools; and be stated relative to meaningful values, such as earnings or capital. For example, effective earnings exposure limits will communicate to bank personnel the maximum percentage of earnings (either net interest income or net income) that the board is willing to put at risk in certain interest rate shock scenarios (e.g., a parallel rate change of +300 basis points). Long-term interest rate risk exposures are best stated relative to a bank’s capital level. Earnings and capital limits will allow management and the board to effectively determine whether earnings are adequate to sustain short-term earnings exposures and whether sufficient capital is in place to cover long-term risk exposures.

Risk Measurement and Reporting

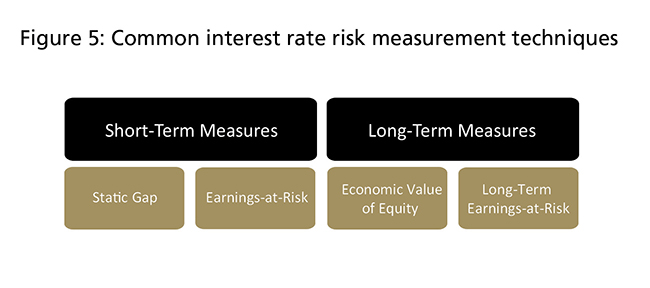

Perhaps the most discussed interest rate risk management topic for community banks is risk measurement. Questions often arise regarding the types of tools or models that are needed, how to fine-tune those tools, and how often measurement reports should be provided to the ALCO and the board. At the most basic level, regulatory expectations require a bank’s interest rate risk measurement tools and techniques to be sufficient to quantify the bank’s risk exposure. Measurement techniques typically fall into two broad categories: short-term and long-term risk measures (Figure 5).

Short-term measurement techniques should quantify the potential reduction in earnings that might result from changing interest rates over a 12- to 24-month horizon. Common measures include repricing gap (or “static gap”) reports and earnings-at-risk (EaR) analysis.4 While long-term net income simulations (up to five years) are occasionally used at community banks, the most common long-term measurement technique is some variation of economic value of equity (EVE).5 While the interagency guidance states that simple static gap reporting may be sufficient for small banks with less complex interest rate risk profiles, regulators expect that management and directors of banks with more complex risk profiles will evaluate and actively manage earnings at risk and economic value exposures. Examples of increased complexity include elevated levels of assets with embedded options, increased mortgage banking activities, or the use of financial derivatives.

Once management and the board have determined the appropriate measurement tools for evaluating interest rate risk exposures, a decision must be made regarding reporting frequency. This decision should also be based on a bank’s inherent risk profile. Banks with low interest rate risk profiles typically provide risk measurement reports to the ALCO and the board at least quarterly. As a bank’s risk profile increases, either through an elevated EaR or economic value exposure or increased holdings of more complex assets, reporting frequency to the ALCO or the board should also increase. It is not uncommon for community banks with moderate and high risk exposures to provide monthly reports to the ALCO and quarterly reports to the full board of directors.

Regardless of reporting frequency, sufficient information should be provided to allow decision-makers to evaluate the sources of exposures and identify potential noncompliance with risk limits. In situations where interest rate risk exposures exceed the bank’s risk limits, senior management should also provide a report to the board detailing actions planned to return the bank to an acceptable risk level, and subsequent meetings should include updates to those action plans. It is important to document policy exceptions and resulting action plans in board and ALCO minutes. During examinations, examiners will evaluate the adequacy of the risk measurement tools to quantify the institution’s risk exposures, controls, and accuracy of assumptions used to generate model results (if an interest rate risk model is being used), as well as the appropriateness of information reported to management committees and the board.

Internal Controls and Audit

The interagency advisory and subsequent FAQs attempt to bring greater clarity to regulatory expectations about internal controls and audit requirements. Examiners have long expected all banks to maintain appropriate controls over risk measurement and reporting processes. Generally speaking, these controls include secondary reviews of data accuracy in risk measurement tools, reporting of compliance with policy limits, and periodic review and documentation of the reasonableness of assumptions used in risk measurement tools.

As community banks have increased their use of interest rate risk models, examiners have expected management teams to take greater steps to ensure that data, assumptions, and output are reasonable and accurate.

At a minimum, an independent review of data inputs, key assumptions,6 the accuracy of ALCO and board reports, and policy compliance should be conducted annually.

An independent review does not necessarily need to be conducted by a consultant or external party, but the reviewer must be independent of interest rate risk management activities and have sufficient understanding of accounting, modeling, and risk management requirements to be competent to complete the review. For community banks with increasing balance-sheet complexity or scope of activities, adequate independence and competency often require contracting with an outside party. As with any type of independent review or audit, results should be reported to the board, and action plans should be developed to address identified weaknesses.

Common Pitfalls

One of the unique opportunities examiners have is to observe both best practices and common weaknesses at a broad cross-section of banks. At community banks, three common deficiencies in interest rate risk management tend to recur and are often cited in examination reports as matters requiring board attention.

First, many examiners have reported that they often find gaps between board-prescribed risk limits and the risk measurement tools used to quantify risk exposures. For example, a bank policy may specify a risk limit in terms of EVE, but the bank’s risk measurement tool may not measure EVE exposures. While not every risk measure captured by the measurement tool requires a risk limit, the risk limits established by the board should be routinely calculated and reported. If the risk limit can’t be captured by the risk measurement tool in place, the board should determine whether a new, appropriate, and calculable limit should be established or whether a new risk measurement tool is needed.

Second, many examiners have evaluated assumptions used in interest rate risk models and determined that default or industry standard assumptions provided by the vendor have never been evaluated or customized by the bank’s management team. While certain vendor-provided assumptions may be appropriate for some banks, the management team should evaluate the reasonableness of those assumptions before accepting them for use in a given model.

Third, many banks have not incorporated independent or third-party reviews to ensure the integrity of their interest rate risk management programs. Since 2010, this has been perhaps the most prevalent interest rate risk matter identified by examiners, as community bank management teams work to comply with the guidance set forth in the interagency advisory.

Conclusion

Community banks face a number of formidable challenges in the current economic environment. However, with appropriate interest rate risk management programs, the inherent interest rate risks that are intrinsic to banking can be managed effectively for given levels of capital and earnings.

- 1 Discussed in greater detail in the Federal Deposit Insurance Corporation’s Winter 2009 Supervisory Insights article, "Nowhere To Go But Up: Managing Interest Rate Risk in a Low-Rate Environment."

- 2 SR Letter 10-1, "Interagency Advisory on Interest Rate Risk," and SR Letter 12-2, "Questions and Answers on Interagency Advisory on Interest Rate Risk Management," are available at http://www.federalreserve.gov/boarddocs/srletters/2010/sr1001.htm

and http://www.federalreserve.gov/bankinforeg/srletters/sr1202.htm.

and http://www.federalreserve.gov/bankinforeg/srletters/sr1202.htm.

- 3 The Bank Director’s Desktop is available at http://www.bankdirectorsdesktop.org.

- 4 EaR analysis calculates revenues and expenses based on various interest rate scenarios and assumptions established jointly by management and model vendors regarding price sensitivities, asset prepayments, reinvestment of cash flows, and deposit mix changes (among other factors). Net interest income or net income results from these calculations are then compared to a base case (no rate change) scenario to determine how much income exposure exists with each interest rate change scenario.

- 5 EVE analysis computes expected cash flows related to asset and liability accounts, given various interest rate scenarios based on assumptions established jointly by bank management and model vendors. These cash flows are discounted to arrive at present values of bank equity, and these present values are compared with discounted economic values of bank equity for a zero interest rate change scenario to express the risk exposure as a percent change in EVE.

- 6 Key assumptions for interest rate risk models could include asset prepayment speeds, nonmaturity deposit assumptions, and interest rate price sensitivities for significant balance-sheet accounts. Price sensitivities refer to the percent change for asset or liability pricing for a 100-basis-point change in the underlying interest rate (e.g., rates for savings accounts may increase 15 basis points for every 100-basis-point increase in interest rates).