Upgrades to Supervisory Ratings for Community Banking Organizations

By Bob Rell, Senior Specialist, Federal Reserve Bank of Philadelphia

Banking is a dynamic industry and supervisory ratings should reflect this characteristic. It is important that supervisory ratings accurately reflect a bank’s underlying financial performance, risks, and management effectiveness. A variety of internal and external factors can influence an individual bank’s examination rating. Examiners carefully consider the most pertinent factors, rigorously discuss preliminary examination findings, and take a fair and thoughtful approach when making their final determinations.

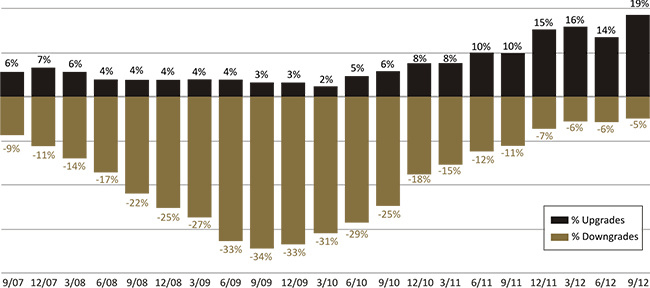

The financial crisis and protracted recession exerted considerable stress on the financial condition of many banking organizations. At some institutions, asset quality deteriorated rapidly, internal risk management weaknesses that may have been hidden during more stable economic times emerged, and capital and liquidity positions faced unprecedented market pressures. Consequently, the safety and soundness ratings for these institutions were often downgraded. Some measure of the extent of downgrades can be gleaned from the number of "problem" commercial banks tracked nationwide. In the third quarter of 2007, there were 44 composite rating downgrades to a composite CAMELS rating of "3" or worse. The downgrade count swelled to 393 in the fourth quarter of 2009 and then gradually receded to 30 in the third quarter of 2012.

Significant improvement in bank performance tends to lag an economic recovery, in part because of troubled assets that remain on banks’ balance sheets even after the recovery begins. As economic conditions have stabilized and started to improve, a cautious optimism about bank performance has emerged. Some notable improvement in bank ratings is already evident. For instance, as shown in the figure, a larger percentage of commercial banks received composite rating upgrades than received composite rating downgrades during examinations conducted in the past four quarters.

Supervisory Guidance

In March 2012, the Federal Reserve Board issued Supervision and Regulation (SR) Letter 12-4, "Upgrades of Supervisory Ratings for Banking Organizations with $10 Billion or Less in Total Consolidated Assets,"1 to ensure that Federal Reserve examiners apply consistent standards for evaluating whether community banking organizations are eligible for supervisory rating upgrades. The guidance, which is primarily directed toward state member community banks,2 was developed to ensure that timely upgrades occur when the banking organizations have made the requisite progress in addressing supervisory concerns.

While the guidance reiterates long-standing policies and practices, SR 12-4 goes on to delineate examiners’ key considerations when assigning ratings in a period of stabilized or generally improving economic conditions, as well as to provide additional detail about the factors the Federal Reserve considers when evaluating whether an upgrade is warranted. Such factors include a demonstrated improvement in the organization’s financial condition and risk management practices and indications of the likelihood that improvement will continue.

Figure: Percent of Commercial Bank Examinations Each Quarter That Resulted in CAMELS Composite Rating Upgrade or Downgrade (downgrades are shown as negative percentages)

Includes any change in composite CAMELS rating for all commercial banks nationwide; quarterly trends based on examination completion dates (mail dates); preliminary September 2012 figures.

Notable factors that could substantiate an upgrade include evidence that:

- Key weaknesses that contributed to previous ratings have been addressed and risk management practices have been reinforced with appropriate policies. The board of directors should be actively engaged in the strategic review and oversight process and should ensure that deficiencies are corrected in a timely manner.

- Adversely classified and nonperforming assets are at manageable levels given the institution’s capital levels and risk management practices, with evidence that the current level and improving trends are sustainable.

- Core earnings show improvement and sustainability, and management’s projections and assumptions related to core financial factors are deemed reasonable.

- Capital levels, quality, and planning are commensurate with the organization’s risk profile.

- Liquidity and interest-rate risk positions are generally being managed prudently and in accordance with supervisory expectations.

The Federal Reserve will also consider whether the organization has demonstrated a sustained improvement in particular areas relevant to the organization’s operation and financial condition as noted in reports of examination and condition.

Despite the recent turbulence the banking industry has endured, the financial system could emerge stronger and more resilient after the crisis, in part because of the steps that banks and supervisors are taking to address risk management and increase overall financial strength. As conditions continue to improve and bank performance trends and outlooks strengthen, the Federal Reserve strives to ensure that evaluations of community bank supervisory ratings are conducted thoroughly and consistently and that timely upgrades occur when warranted.

- 1 See www.federalreserve.gov/bankinforeg/srletters/sr1204.htm.

- 2 While the factors discussed are particularly relevant for (but not exclusive to) state member community banks with consolidated assets of $10 billion or less, they can be applied to other types of institutions supervised by the Federal Reserve.