Municipal Lending at Community Banking Organizations — Emerging Risks?

by Ivy M. Washington, Supervisory Examiner, and William T. Wisser, Assistant Vice President, Federal Reserve Bank of Philadelphia

Many banks have viewed lending to municipalities as a relatively low-risk activity and an opportunity for the bank to earn other business from the municipalities, including deposits, cash management, and wealth management. Historically, loans to state or local municipalities were viewed as low-risk lending opportunities because municipalities frequently guaranteed repayment, which was often based on the state or local government's taxing authority. The so-called Great Recession of 2007-2009 and its aftermath have taken a toll on the financial state of many municipalities, making repayment less certain than it once may have been.

This article examines municipal lending by community banks, including common types of credit facilities, recent trends, and effective credit risk management practices.

Common Types of Municipal Lending at Community Banking Organizations

Various types of loans are made directly or indirectly to municipalities. These loans are repaid through general cash flows or through specific revenue streams, such as water and sewer fees or stadium and parking fees. In the past, community banks typically financed small municipal projects, such as purchasing new equipment or vehicles or providing a working capital line of credit to offset the seasonality of the municipality's cash flow. More recently, however, bank examiners have observed several community banks financing potentially riskier projects.

Project Finance

Over the past several years, examiners have observed a shift in smaller project financing away from capital markets to financial institutions. During the Great Recession, some municipalities either lost their investment ratings or saw their bond insurance premium costs increase; therefore, the cost of issuing debt securities in the capital markets increased. As a result, these smaller municipalities are turning to financial institutions to finance these projects.

Generally, these projects are longer term and supported by cash flows generated from the project. If cash flows are insufficient to meet the debt service requirements, the financial institution might be forced to restructure the transaction or obtain financial support from the municipality. Municipalities do not guarantee this type of debt but often offer financial support to ensure that services continue to be provided to their citizens. However, there are some cases in which the municipality may withdraw its financial support from a project. This occurred in Scranton, PA, in June, 2012.

The Scranton Parking Authority (SPA) was saddled with debt and dwindling liquidity in 2012. The SPA had insufficient cash to make its loan payment and therefore reached out to the City of Scranton for funding. The City of Scranton, also strapped for cash, decided not to fund the payment, which resulted in a default.

As with any lending, it is important that bank management understands the financial condition of the borrower (in this case, the municipality) and the ability and willingness of the borrower to make the required payments. Management should also understand that not all municipal loans are created equal. Certain loans to municipalities could pose significant credit risks to the institution, which management must incorporate into its methodology for determining the adequacy of the allowance for loan and lease losses.

Tax and Revenue Anticipation Notes

Tax anticipation notes (TANs) and revenue anticipation notes (RANs) are generally short-term, self-liquidating loans or lines of credit to meet the cash flow needs of a municipality. These notes will be repaid with future tax collections, in the case of TANs, or revenues from the project that is being financed, in the case of RANs. Typically, these loans or lines of credit are tied to a specific revenue source and are collateralized by the revenue source. These obligations are generally repaid annually. New obligations are granted based on expected cash flow needs.

When a municipality is unable to repay a TAN or RAN or needs to fund fixed obligations, it will often turn to a financial institution or the capital markets to refinance the existing debt and amortize it over a defined period of time. In some cases, municipalities layer additional debt on the balance sheet in the hope that cash flow improves in future years. If cash flow continues to deteriorate or does not meet expectations, the municipality may be forced to borrow funds to meet the statutory requirement of a balanced budget. By borrowing additional funds, the layering of debt may place the municipality into a debt spiral that could lead to more serious financial problems. Bank management should carefully review these types of requests to ensure that it understands the challenges facing the municipality. Local leaders should also be prepared to make difficult decisions on taxes and expenditures if the municipality's cash flow does not improve.

Recent Bankruptcy Filings by Municipalities

Most U.S. municipalities appear to be in reasonably sound financial condition; however, over the past three years several larger municipalities have filed for bankruptcy protection under Chapter 9 of the Bankruptcy Code.1 For example:

- Detroit filed for bankruptcy protection in 2013 with $18.5 billion in liabilities, which to date ranks as the largest municipal bankruptcy;

- Jefferson County, Alabama, filed for bankruptcy protection in 2011 with about $4 billion in liabilities;

- San Bernardino, CA, filed for bankruptcy protection in 2012 with $1 billion in liabilities; and

- Stockton, CA, filed for bankruptcy protection in 2012 with $700 million in liabilities.

In 2012 alone, 20 municipalities filed for Chapter 9 bankruptcy protection, the highest number of filings since 1991. Although only nine municipalities filed bankruptcy petitions in 2013, the largest municipal bankruptcy was filed in July 2013, as discussed below.2

Most of these cases resulted from changing demographics and falling real estate values, which adversely affected revenue sources for municipalities, while expenditure cuts did not keep pace. Municipalities are sometimes unable to cut certain expenditures given that they are fixed by other governing bodies, union contracts, or pension obligations. In these circumstances, municipal officials may be tasked with the difficult decision to cut services, restructure contracts and pension benefits, borrow funds, seek new revenue sources to balance budgets, or, in a worst-case scenario, file for Chapter 9 bankruptcy protection.

Detroit Bankruptcy Filing

Let's look at Detroit as an example of what can happen. Detroit filed for bankruptcy protection on July 18, 2013, because its budget and pension obligations were too large relative to its diminished taxpayer base. The population in Detroit has shrunk from nearly 2 million individuals in 1950 to about 700,000, according to the results of the 2012 census, and over the past decade alone the population has declined by 25 percent.3 As a result, city leaders were forced to raise taxes and borrow additional funds in an attempt to balance the city's budget. Despite these efforts, the City of Detroit in recent years spent more than it brought in as revenue. This spending, coupled with the mandate to balance the budget annually, resulted in additional borrowings that saddled the city with a heavy debt load and ultimately resulted in the city filing for bankruptcy.

Detroit's total debt now exceeds $18 billion, which includes significant health-care and pension-related debt and obligations backed by enterprise revenue, as well as secured and unsecured debt, interest rate swap exposure owed to banks, and other liabilities.4 As Detroit emerges from bankruptcy, it will be interesting to see how these liabilities are right-sized for a shrinking city and the potential impact to other municipalities facing similar challenges.

Other Municipalities and States with Potential Financial Troubles

Some municipalities and states have seen revenues drop due to falling real estate values, foreclosures, and a low interest rate environment. Although raising taxes and fees may increase revenues, municipal officials often try to minimize the burden of higher taxes and fees on their citizens, especially when unemployment is already high.

The cost of health-care and pension obligations seems to be the most significant expenditure for many municipalities and states. Because of the low interest rate environment, a number of pension funds have become significantly underfunded over the past five years; a 2011 study estimated that the total unfunded pension liabilities of all U.S. cities and counties was $574 billion.5 A report by Moody's also concluded that unfunded pension liabilities may be understated because of unrealistic assumptions tied to expected rate of return and the life expectancies of retirees.6 If more realistic assumptions are applied, Moody's found that some states had large unfunded pension liabilities as a percentage of total state revenue, including the following:

- Illinois (241 percent)

- Connecticut (190 percent)

- Kentucky (141 percent)

- New Jersey (137 percent)

- Hawaii (133 percent)

- Louisiana (130 percent)

The impact of unfunded pension liabilities on states' and local municipalities' budgets is significant and will likely affect the financial performance of most of these entities over the next several years, if not decades. As a result, financial institutions should closely monitor the overall financial condition of municipalities when deciding whether to lend or invest.

Growth in Municipal Lending by Community Banking Organizations

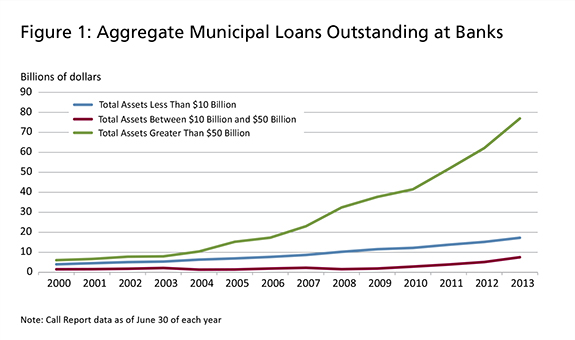

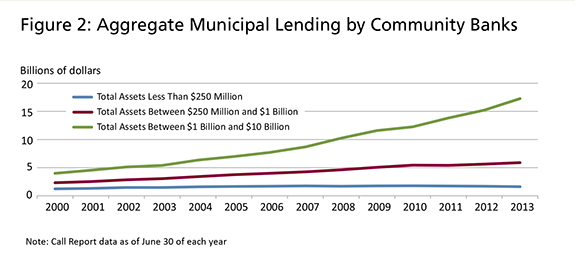

Municipal lending has increased steadily since 2007 and totaled $102 billion as of June 30, 2013 (Figure 1). Most of this growth was in financial institutions with total assets greater than $50 billion; however, community banks, defined as those financial institutions with total assets of $10 billion or less, also reported a steady increase in municipal loans. Much of this increase was reported by the largest community banks (those with total assets between $1 billion and $10 billion), which reported an increase in municipal loans of 157 percent since 2007 (Figure 2). Moreover, community banks have reported an increase in municipal loans of nearly 25 percent over the past two years.

Several community banks also reported significant concentrations in municipal loans that must be closely monitored. For example, as of June 30, 2013, 33 community banks reported municipal lending that represented more than 50 percent of tier 1 capital plus the allowance for loan and lease losses, including four organizations that had levels greater than 100 percent of tier 1 capital plus the allowance. At these levels, bank examiners would expect institutions to have robust risk management practices in place to properly assess concentration risk within the loan portfolio.

Municipal Lending Challenges

All municipalities have ongoing funding needs, which can include managing cash flow, balancing the fiscal budget, purchasing new equipment, and financing improvements in infrastructure. For those municipalities that are financially sound, the credit risk of lending for these purposes may be limited. However, some municipalities are financially distressed or are enduring significant financial struggles, raising questions as to whether they are creditworthy. As seen over the past two years, municipal bankruptcy filings are a real possibility. Therefore, to protect against financial loss and to mitigate risks, institutions should implement a robust due diligence process and conduct ongoing monitoring to ensure the municipal debt outstanding can be satisfied or, in a worst-case scenario, recovered.

An effective risk management framework is a critical factor in establishing a sound municipal lending program. Sound risk management principles include a formal written loan policy and limits, credit concentration monitoring procedures, sound loan administration and documentation practices, and an independent and reliable loan review program. Banks are expected to adhere to policies and procedures, with exceptions properly justified and documented.

While municipal lending is similar to commercial lending, how the loans are made and maintained can require different approaches and underwriting processes. Consideration should be given to secondary sources of collateral, as well as the municipality's willingness and ability to increase taxes or cut operational costs. Bank management should also obtain and maintain current financial statements and other relevant documentation to assess the municipality's financial condition and its ability to repay its debt.

Municipal loans are contracts that are designed in a similar manner to other commercial loans. Financial institutions are expected to adhere to prudent banking practices and relevant regulatory guidelines governing lending practices.

Conclusion

Community banking organizations will continue to remain a vital source of funding for municipalities for the foreseeable future, and the Federal Reserve encourages banks to make loans to creditworthy individual and institutional borrowers. As some municipalities continue to struggle financially, however, and with additional bankruptcy petitions possible, the view that municipal lending is a low-risk lending activity may be debatable. Municipal lending can be a profitable activity that meets the financing needs of the communities in which banks operate, but banks should ensure that they have an effective risk management program in place to address risks and regulatory concerns related to municipal lending.

Back to top

-

1

Municipal debtors must file under Chapter 9 of the U.S. Bankruptcy Code (Adjustment of Debts of a Municipality), 11 U.S.C. section 901 et seq. Chapter 9 is

available at

www.gpo.gov/fdsys/pkg/USCODE-2012-title11/pdf/USCODE-2012-title11-chap9.pdf.

-

2

The statistics are from the United States Courts at

www.uscourts.gov/Statistics/BankruptcyStatistics.aspx.

-

3

See Kate Linebaugh, "Detroit's Population Crashes," Wall Street Journal, March 23, 2011, at

http://ow.ly/vRa9K.

-

4

Information about the Detroit bankruptcy filing is available on the United States Bankruptcy Court for the Eastern District of Michigan website at

www.mieb.uscourts.gov/apps/detroit/DetroitBK.cfm.

-

5

See Robert Novy-Marx and Joshua Rauh, "The Crisis in Local Government Pensions in the United States," in Yasuyuki Fuchita, Richard J. Herring, and Robert

E. Litan, eds., Growing Old: Paying for Retirement and Institutional Money Management After the Financial Crisis, Washington, D.C.: Brookings

Institution Press and Nomura Institute of Capital Markets Research, 2011, available at

www.stanford.edu/~rauh/research/NMRLocal20101011.pdf.

-

6

See Moody's Investors Service, "Adjusted Pension Liability Medians for U.S. States," June 27, 2013, available at

http://ow.ly/xQ9nr.