Bank-Owned Life Insurance: A Primer for Community Banks

by Cynthia L. Course, CPA, Principal, Federal Reserve Bank of San Francisco

Since the 1980s, banks have purchased bank-owned life insurance, or BOLI, for various business purposes — most commonly to recover losses associated with the death of a key person, to recover the cost of providing pre- and post-retirement employee benefits, and to provide a direct employee benefit. While the products and the reasons for purchasing BOLI are not new, the overall use of BOLI at community banks has been increasing, and regulators continue to receive questions about BOLI investments by community banks.

This article provides an overview of the different types of BOLI, trends in BOLI holdings at community banks, the unique risks of BOLI, and the impact of the revised capital framework on BOLI investments by community banks.

A BOLI Primer

Key-Person Versus Split-Dollar Life Insurance

Key-Person Life Insurance: When the death of a bank officer or other key person would be of such consequence to the bank as to give it an insurable interest, key-person life insurance insures the bank on the life of the individual. The bank generally pays the entire premium and is the beneficiary. The primary purpose of this type of insurance is to indemnify the bank against the potential loss of net income that may result from the death of the insured.

Split-Dollar Life Insurance: This policy is a form of additional direct compensation, whereby the bank pays part or all of the insurance premiums and the executive's beneficiary receives some or all of the death benefit.

BOLI is a life insurance policy purchased by a bank or bank holding company to insure the life of certain employees. Typically, the insured employee is an officer or other highly compensated employee, but a bank may purchase insurance for any employee. Since the bank owns the policy, the bank receives the proceeds from the death benefit, accrues revenue from investment earnings, and bears the risk of investment losses. However, banks may also purchase split-dollar life insurance policies as an employee benefit. With these policies, the bank and the employee share rights to the policy's cash surrender value (CSV) and death benefits (see box at right).1 This article focuses solely on the BOLI policies owned by banks.

When purchasing BOLI, the bank often pays a single premium, which may range from thousands to millions of dollars depending on the nature of the policy. On the Call Report, the purchase of BOLI results in an increase in the "Life Insurance Assets" category on Schedule RC-F, "Other Assets." Over time, the reported CSV — the amount the bank would recoup after surrender charges but before taxes if it were to liquidate its BOLI holdings — is adjusted to reflect performance of the underlying investment(s). The primary benefit of BOLI is tax-related: Income earned on the policies is tax-free for the bank, and when an employee dies, the cash payments the company receives are tax-free.

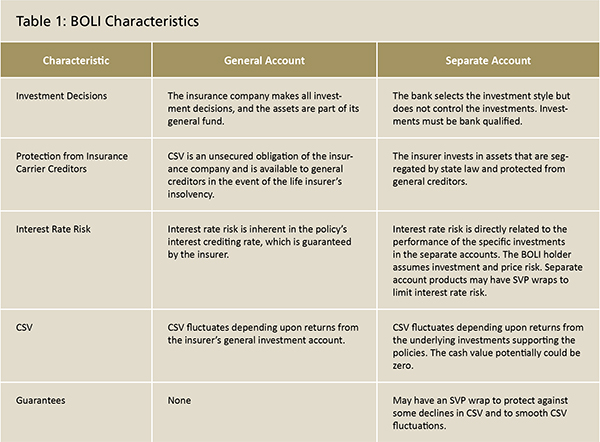

There are two primary types of BOLI — general account and separate account — with a third "hybrid" category as well. The features of general account and separate account BOLI are summarized in Table 1. General account BOLI is a fairly straightforward product and is reasonably easy to understand. Separate account BOLI may be very complex, particularly when stable value protection (SVP) wraps2 are included in the contract. Hybrid BOLI generally combines elements of both types of policies, providing the creditor protection of separate account BOLI with the minimum guaranteed rates of general account BOLI.

BOLI Holdings at Financial Institutions

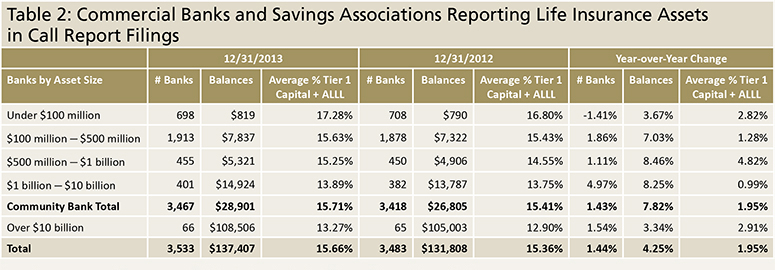

The number of banks reporting life insurance assets and the total reported balances of these assets have been increasing.3 As shown in Table 2, more than 3,500 commercial and savings banks reported over $137 billion in life insurance assets at year-end 2013. And it is clear from the table that BOLI is not just a product for large banks; 3,467 community banks reported $29 billion in BOLI assets at year-end 2013. This was an increase not only in the number of community banks reporting life insurance assets but also in the balances outstanding and the level of the concentration of life insurance measured as a percentage of tier 1 capital plus the allowance for loan and lease losses (ALLL). There are likely many reasons for the increase in BOLI balances. One probable cause is the appreciation of the underlying investments. However, it is also possible that some institutions are purchasing new BOLI policies to obtain a higher tax-equivalent yield than is available on many securities or loans, which may raise supervisory concerns if banks do not understand the associated risks or do not have adequate risk management processes in place.

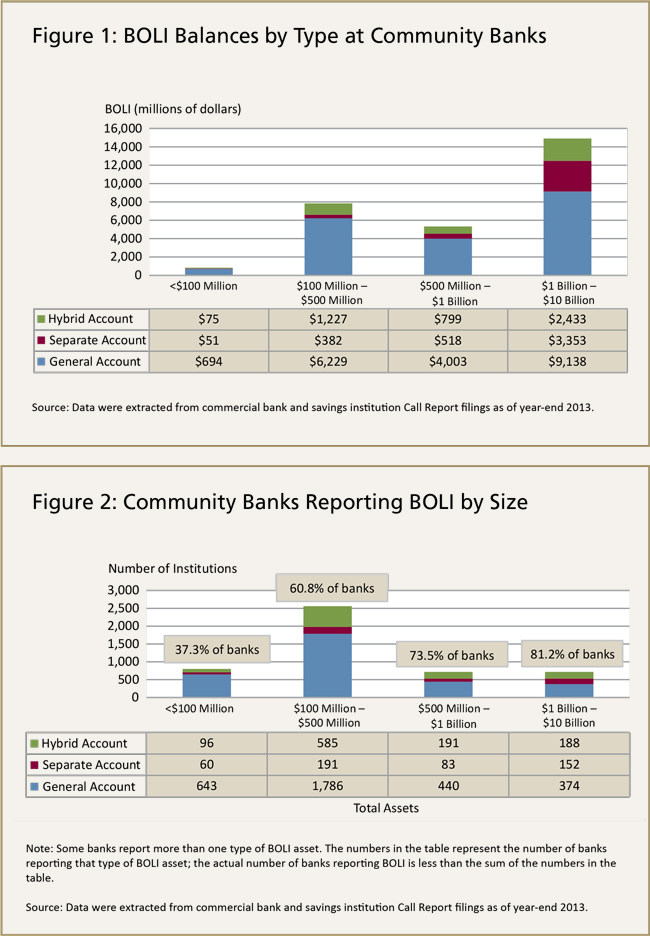

The type of BOLI held generally varies by the size of the bank. As shown in Figure 1, most community bank BOLI assets are considered "simpler" general account assets, which are unsecured obligations of the insurance company. However, at larger community banks as a whole, the balances of BOLI assets in separate accounts or hybrid accounts grow. The type of BOLI policy affects not only the risk of the assets but also their risk weighting for capital purposes.

The likelihood that a community bank will hold BOLI assets also increases with its size. As shown in Figure 2, community banks of all sizes hold BOLI assets, with a positive correlation between bank size and percentage of banks reporting BOLI assets.

Concentrations of BOLI investments at some institutions are significant. As of year-end 2013, 363 institutions nationwide reported CSV greater than 25 percent of the sum of tier 1 capital and ALLL, which is a measure that the Federal Reserve uses to gauge concentrations. Twenty of those institutions, including 18 community banks with assets less than $50 million, reported CSV greater than 50 percent of tier 1 capital and ALLL. While it may be understandable that smaller community banks have a greater BOLI concentration because of their relatively smaller balance sheets, they must be aware of and actively manage and mitigate the additional risks.

Supervisory Guidance

Given the number of institutions that own BOLI, the agencies have issued guidance on BOLI risk management and accounting. In December 2004, the Board of Governors of the Federal Reserve System, along with the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation, issued an "Interagency Statement on the Purchase and Risk Management of Life Insurance."4 This statement expanded upon the interagency guidance issued in February 2004, "Interagency Advisory on Accounting for Deferred Compensation Agreements and Bank-Owned Life Insurance (BOLI)."5 Although issued almost 10 years ago, the 2004 interagency statement and advisory remain relevant and helpful today.

The December 2004 interagency statement provides additional information — on topics such as the legal authority under which banks may purchase BOLI as well as BOLI accounting considerations — that is beyond the scope of this article. The interagency statement also provides a very detailed discussion of BOLI risk management considerations, which community banks owning or contemplating the purchase of BOLI are encouraged to consider. Finally, the interagency statement includes an appendix that discusses insurance types and purposes and provides a glossary of insurance-related terminology.

The remainder of this article focuses on two additional areas addressed in the interagency statement: BOLI risks and BOLI risk-based capital considerations.

BOLI Risks

An effective board of directors and management team will consider the risks of BOLI when deciding whether to purchase life insurance on its employees. This section highlights some of the risks associated with BOLI.6 Bank examiners take BOLI into consideration when assessing the institution's overall financial condition and risk profile and when assigning supervisory ratings.

Credit Risk

The performance of any life insurance contract depends on the financial condition of the insurance company that underwrites or guarantees the contract and the ability of that insurance company to honor the payment terms of the contract. Given that most insurance contracts are long-term assets, the insurance company's financial condition and ability to pay must be reviewed regularly over the life of the contract, just like a bank would review a borrower's financial condition and ability to pay on a regular basis. As part of the credit risk assessment, a bank should conduct a thorough analysis, including consideration of external information on creditworthiness as appropriate.

As discussed previously, a bank purchasing general account BOLI owns an unsecured obligation of the insurance company, whereas a bank holding separate account BOLI has some protection from the company's general creditors. With separate account BOLI, banks primarily face credit risk from the underlying holdings in the separate account. However, even separate account BOLI holders may be exposed to the credit risk of the issuer; the difference between the minimum guaranteed death benefit and the CSV of the separate account BOLI is an unsecured obligation of the insurance company.

In addition, a bank should consider the credit risk arising from a separate account BOLI policy's SVP wrap. The bank may have credit risk exposure to both the third party that provides the SVP wrap and to the insurance company responsible for the final payment under the policy.

The credit risk exposure associated with BOLI also raises concentration concerns. To mitigate credit concentration risk (as well as potential legal risk), management should establish appropriate policy limits on exposures to insurance companies, taking into consideration regulatory capital concentration thresholds, state legal lending limits, and any applicable state restrictions on BOLI holdings.

Market Risk

The market risk, or interest rate risk, of BOLI products differs based on the structure of the product. In general account BOLI, where the investments are held in the insurance company's general account, interest rate risk is inherent in the policy's credited interest rate; this is based, in turn, upon the insurance company's own investment results. Because the maturity of the assets in the insurance company's general accounts is often longer term, the value of the investments may fluctuate significantly when long-term interest rates change.

In separate account BOLI, interest rate risk is directly related to the specific investments held in the separate account. While this is similar to the market risk exposure in the bank's own investment portfolio, it is more difficult for management to control this risk because management cannot control the separate account assets. One way to mitigate some of this risk is through the purchase of an SVP wrap, which protects against declines in the value of the separate account assets due to changes in interest rates (although, as noted previously, SVP wraps are not without their own risks).

Liquidity Risk

The cash surrender value of BOLI, whether in a general account or separate account, is one of the least liquid assets on a bank's balance sheet. Additionally, the bank generally does not receive any cash flow from the BOLI investment until the death of the insured. There are typically only two ways to extract liquidity from a BOLI policy before the death of the insured: surrender the policy or borrow against the policy. Both of these tactics may have significant tax consequences and fees. Bank management and the board of directors should consider the institution's liquidity profile when purchasing BOLI as well as the level of BOLI assets when making other liquidity decisions.

Operational Risk

Operational risk in BOLI transactions most often arises from the complex structures of the contracts. General account BOLI is less complex than separate account or hybrid BOLI, with only two parties engaging in the contract and fewer variables. However, general account BOLI policies include potentially complex factors such as the interest-crediting rate, expense charges, and mortality costs.7 Separate account BOLI introduces a host of other complexities, including third parties (the separate account investment manager and any SVP wrap provider), additional investment options, terms of the SVP wrap, CSV provisions, and mortality options. Management must clearly understand all the contractual language to ensure that the policies provide the expected benefits and that the institution is and will remain able to comply with any covenants in the contracts. Further, tax and other laws, as well as accounting rules, may change over time, and these changes may negatively affect the original appeal and financial advantage of BOLI.

Legal Risk

The purchase and retention of BOLI exposes a community bank to a variety of legal and compliance risks. Life insurance is a complicated product, governed by myriad state insurance laws. The purchase of BOLI, which by definition is life insurance on an employee, also introduces employment law, tax law, and reporting considerations. Various Federal Reserve regulations, such as Regulations O and W, which address transactions with insiders and affiliates, may also apply to aspects of BOLI transactions. Because of the complexity of BOLI products and the potentially significant legal and compliance risks, institutions should consult with counsel on BOLI legal and regulatory issues.

Reputational Risk

A bank faces reputational risk from virtually all the products and services it offers. However, because a bank owning BOLI will benefit from the death of its employees, it must actively manage and mitigate potential perception issues that could arise. Longer-tenured bankers may recall the controversy over so-called "janitor's insurance" in the early 2000s, where companies were purchasing insurance on very junior-level employees without their knowledge. In response to this issue, Congress passed the Pension Protection Act of 2006. Section 863 of the act amended the Internal Revenue Code to require that the employer, before the contract is issued, notify the insured in writing that the employer intends to procure insurance coverage, including the maximum face value for which the person could be insured; obtain the insured's written consent to the coverage and to the possible continuation of the coverage after the insured terminates employment; and inform the insured in writing that the employer will be the contract beneficiary.8 To mitigate reputational risk and potentially significant adverse tax consequences, management and the board of directors must ensure that each covered employee has given informed consent before the institution purchases the insurance. Passive disclosures through employee handbooks or newsletters are not sufficient.

Risk-Based Capital Treatment Under the Revised Regulatory Capital Framework

The complex distinctions between general account BOLI and separate account BOLI also extend to the risk-based capital treatment under the regulatory capital framework that was revised in July 2013.9 Because the obligor for general account BOLI is the insurance company, general account BOLI is treated as a corporate exposure under the capital framework and is risk-weighted at 100 percent. This is consistent with the risk-based capital treatment under the 2004 interagency statement cited previously.

Look-Through Approaches

Full Look-Through: The bank calculates the risk-weighted asset amount for its pro-rata share of each exposure held by the investment fund in the separate account. This requires detailed knowledge about all account investments.

Simple Modified Look-Through: The bank calculates the risk-weighted asset amount by applying to its CSV the highest applicable risk weight for any exposure in the separate account.

Alternative Modified Look-Through: The bank calculates the risk-weighted asset amount based on the investment limits by risk weight category in the separate account agreement, without regard to the actual composition of the investments.

However, the CSV of separate account BOLI is supported by segregated investments. Under the revised capital framework, an investment in a separate account must be treated as if it were an equity exposure to an investment fund. Banks holding separate account BOLI will be required to use one of three look-through approaches to value these assets, each of which is subject to a risk-weight floor of 20 percent: the full look-through approach, a simple modified look-through approach, or an alternative modified look-through approach. The box above provides a brief summary of these approaches.10 The presence of an SVP wrap further complicates the calculation of risk-based capital for separate account BOLI. The carrying value of the investment in the separate account attributable to the SVP wrap must be treated as an exposure to the provider of the protection and risk-weighted as a corporate exposure, with the balance of the exposure risk-weighted by using a look-through approach.

Summary

BOLI offers many benefits to a community bank, but it is not without risk. BOLI may fund employment benefits to company executives, provide compensation to a company in the event of an executive's death, and offer tax advantages not generally available in other investment alternatives. However, the purchase of BOLI or any other insurance product should be aligned with the objectives of bank management, director-approved risk guidelines, and the bank's risk profile. It is imperative that management understands both the benefits and risks of its insurance decisions and that it appropriately identifies, quantifies, and actively manages all risks. Because of the complexity of life insurance, bank management should seek qualified tax, insurance, and legal advice when considering BOLI purchases.

Back to top

-

1

See Supervision and Regulation (SR) letter 94-23, "Split-Dollar Life Insurance at State Member Banks," available at

www.federalreserve.gov/boarddocs/srletters/1994/SR9423.htm.

- 2 In general, an SVP contract pays a separate account policy owner any shortfall between the fair value of the separate account assets when the policy owner surrenders the policy and the cost basis of the separate account to the policy owner. SVP contracts are most often used to mitigate price risk in connection with fixed-income investments.

- 3 Data in this section were extracted from commercial bank and savings institution Call Report filings as of year-end 2013.

-

4

See SR letter 04-19, "Interagency Statement on the Purchase and Risk Management of Life Insurance," available at

www.federalreserve.gov/boarddocs/srletters/2004/sr0419.htm.

-

5

See SR letter 04-4, "Accounting for Deferred Compensation Agreements," available at

www.federalreserve.gov/boarddocs/srletters/2004/sr0404.htm.

-

6

See also a more general discussion of the Federal Reserve's risk management expectations for banking organizations at SR letter 95-51, "Rating the Adequacy

of Risk Management Processes and Internal Controls at State Member Banks and Bank Holding Companies," available at

www.federalreserve.gov/boarddocs/srletters/1995/sr9551.htm.

- 7 Mortality cost is the pure cost of the life insurance death benefit. It is based on the face amount of the policy and the insured's mortality likelihood.

-

8

Pension Protection Act of 2006, Pub. L. No. 109-280, 120 Stat. 790 (2006), available at

www.gpo.gov/fdsys/pkg/PLAW-109publ280/pdf/PLAW-109publ280.pdf.

-

9

See "Federal Reserve Board Approves Final Rule to Help Ensure Banks Maintain Strong Capital Positions," Board of Governors of the Federal Reserve System

press release, July 2, 2013, available at

www.federalreserve.gov/newsevents/press/bcreg/20130702a.htm.

See also 78 FR 62018 (October 11, 2013), available

at www.gpo.gov/fdsys/pkg/FR-2013-10-11/pdf/2013-21653.pdf.

See also 78 FR 62018 (October 11, 2013), available

at www.gpo.gov/fdsys/pkg/FR-2013-10-11/pdf/2013-21653.pdf.

- 10 A full discussion of the three look-through approaches under the revised risk-based capital rules is beyond the scope of this article.