The Federal Reserve’s Discount Window: What It Is and How It Works

by Pam Hendry, Director, Credit and Risk Management, Federal Reserve Bank of Atlanta

Lending at the Federal Reserve’s Discount Window1 serves two primary functions: (1) as a backup source of liquidity that individual depository institutions can use when faced with temporary, unforeseen changes in their asset and liability structure and (2) as a complement to open market operations in achieving the target federal funds rate by making Federal Reserve balances available to depository institutions when the normal functioning of financial markets is disrupted.

Being prepared to borrow from the Discount Window can be an important component of a depository institution’s planning for both strategic and contingency purposes. Depository institutions that do not envision using the Discount Window in the ordinary course of events are encouraged to execute the necessary documents for contingency purposes because a need for Discount Window credit could arise suddenly and unexpectedly.

This article provides basic information on the Discount Window,2 including the types of borrowing programs available; interest rates; eligibility criteria; and borrowing arrangements, such as documentation, acceptable collateral, and collateral margins.

Types of Borrowing Programs Available

Primary Credit

Primary credit is available to generally sound depository institutions on a very short-term basis, typically overnight. Depository institutions are not required to seek alternative sources of funds before requesting occasional advances of primary credit. The Federal Reserve expects that depository institutions will use the Discount Window as a backup rather than as a regular source of funding, given the above-market pricing of primary credit.

Primary credit may be used for any purpose, including financing the sale of federal funds. The primary credit program complements open market operations in the implementation of monetary policy by making funds readily available at the primary credit rate when there is a temporary shortage of liquidity in the banking system, thus capping the actual federal funds rate at or close to the primary credit rate.

Reserve Banks ordinarily do not require depository institutions to provide reasons for requesting very short-term primary credit advances. Rather, borrowers are asked to provide only the minimum information necessary for the Reserve Bank to process a loan, which is usually the amount and term of the loan. If the pattern of borrowing or the nature of a particular borrowing request strongly indicates that a depository institution is not in generally sound financial condition, the lending Reserve Bank may seek additional information.

Primary credit may be extended for periods of up to a few weeks to small depository institutions in generally sound financial condition that are experiencing short-term funding difficulties or cannot obtain temporary funds in the market at reasonable terms. Large- and medium-sized depository institutions generally have access to market funds to meet their temporary funding needs. Longer term extensions of credit are subject to increased administration as determined by the lending Reserve Bank.

Secondary Credit

Secondary credit may be available to depository institutions that are not eligible for primary credit. The secondary credit program entails a higher level of Reserve Bank administration and oversight than the primary credit program. This type of credit is also extended on a very short-term basis, typically overnight. However, in contrast to primary credit, there are restrictions on the uses of secondary credit. Secondary credit is available to meet backup liquidity needs when its use is consistent with helping a depository institution return to market funding sources or the orderly resolution of a troubled institution. Secondary credit may not be used to fund an expansion of the institution’s assets.

Seasonal Credit

The Federal Reserve’s seasonal credit program is designed to assist small depository institutions in managing liquidity needs that arise above their regular swings in loans and deposits caused by seasonal types of businesses such as construction, college, farming, resort, tourism, and municipal financing. A depository institution may qualify for up to nine months of seasonal credit during the calendar year to assist in meeting the needs of the local communities where it operates.

Interest Rates on Primary, Secondary, and Seasonal Credit

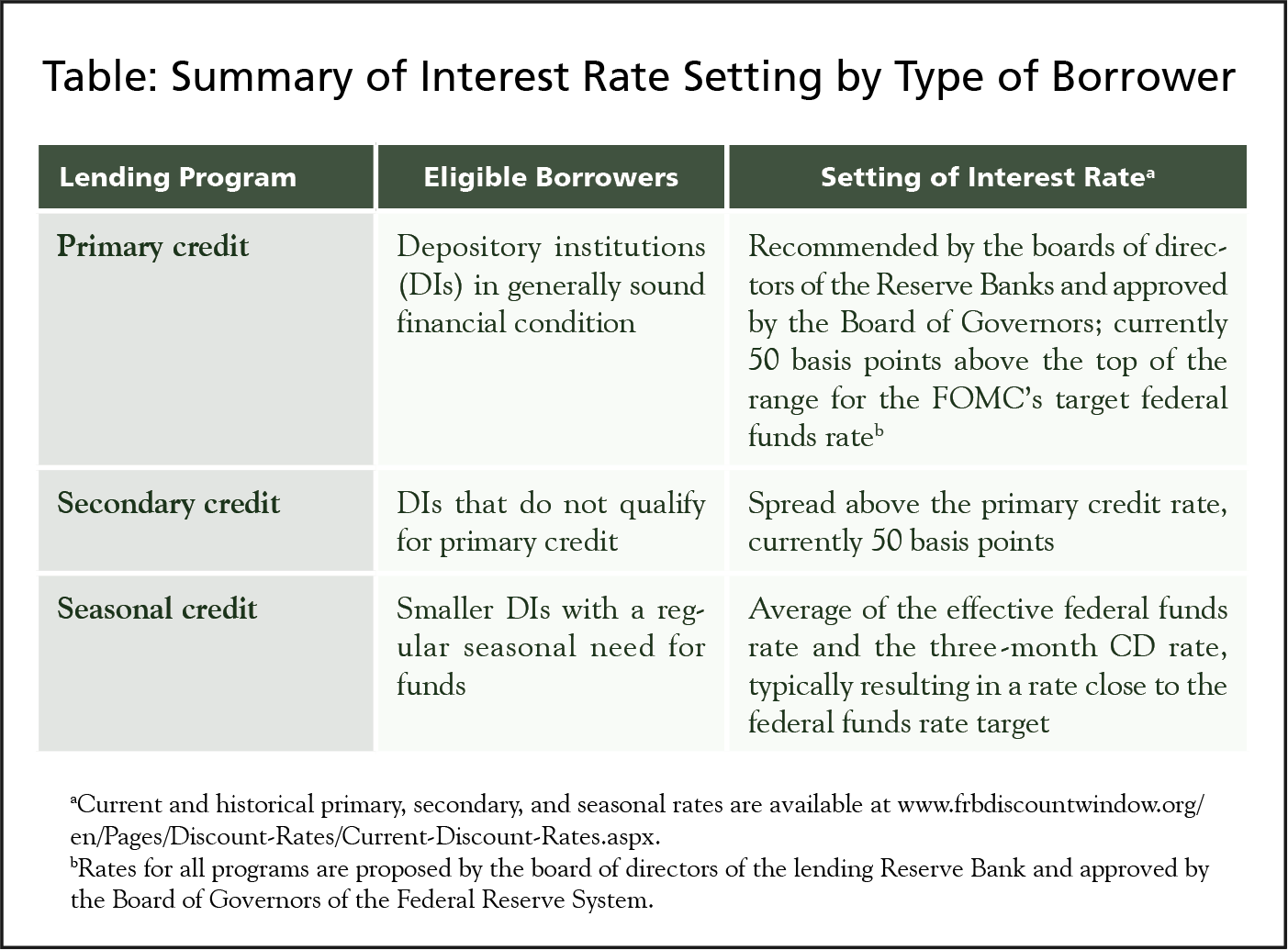

Reserve Banks’ boards of directors establish the primary credit rate at least every two weeks, subject to review and determination by the Board of Governors. The interest rates applied to primary and secondary credit change periodically to complement changes in the Federal Open Market Committee’s (FOMC) target for the federal funds rate and to achieve broad monetary policy goals (see the table above). The interest rate applied to seasonal credit is a floating rate based on market rates.

Eligibility to Borrow

By law, depository institutions that maintain reservable transaction accounts or nonpersonal time deposits (as defined in the Board’s Regulation D) may establish borrowing privileges at the Discount Window. Eligibility to borrow is not dependent on or related to the use of Federal Reserve priced services.

U.S. branches and agencies of foreign banks that hold reserves are eligible to borrow under the same general terms and conditions that apply to domestic depository institutions. Foreign banks with more than one branch or agency operating in the United States may have access to the Discount Window in more than one Reserve Bank District. Any Discount Window loan to those branches or agencies will be made by the Reserve Banks where the borrowing branches or agencies maintain accounts. Reserve Banks coordinate and monitor lending to such branches and agencies on a nationwide basis.

Bankers’ banks, corporate credit unions, and other financial institutions are not required to maintain reserves under the Board’s Regulation D and therefore do not have regular access to the Discount Window. However, the Board of Governors has determined that such institutions may obtain access to the Discount Window if they voluntarily maintain reserves. (Refer to Regulation D for more details.3)

Eligibility for the Credit Programs

Primary Credit

A depository institution must be in generally sound financial condition, as determined by its Reserve Bank, to qualify for primary credit. A Reserve Bank reviews a depository institution’s condition on an ongoing basis using supervisory ratings and capitalization data. Supplementary information, when available, may also be used. Criteria used in determining whether an institution is in generally sound financial condition include but are not limited to:

- An institution assigned a composite CAMELS rating of 1, 2, or 3 (or SOSA 1 or 2 and ROCA 1, 2, or 3) that is at least adequately capitalized is eligible for primary credit unless supplementary information indicates that the institution is not generally sound.4

- Institutions assigned a composite CAMELS rating of 4 (or SOSA 1 or 2 and ROCA 4 or 5) are not eligible for primary credit unless an ongoing examination or other supplementary information indicates that the institution is at least adequately capitalized and that its condition has improved sufficiently to be deemed generally sound by its Reserve Bank.

- Institutions assigned a composite CAMELS rating of 5 (or SOSA 3 regardless of ROCA) are not eligible for primary credit.

Secondary Credit

Depository institutions that do not qualify for primary credit may be eligible for secondary credit when the use of such credit is consistent with a timely return to a reliance on market sources of funding or the orderly resolution of a troubled institution. A Reserve Bank must have sufficient information about a depository institution’s financial condition and reasons for borrowing to ensure that an extension of secondary credit would be consistent with the purpose of the facility.

Note that there are restrictions on lending to undercapitalized depository institutions: The Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA)5 amended the Federal Reserve Act to restrain extensions of Federal Reserve credit to an FDIC-insured depository institution that has fallen below minimum capital standards or has received a composite CAMELS rating of 5 (or its equivalent) from its federal regulator. Such depository institutions may request secondary credit, but Federal Reserve lending to a depository institution that is undercapitalized, significantly undercapitalized, or rated a composite CAMELS 5 (or its equivalent) is generally limited to 60 days in any 120-day period. Ordinarily, a depository institution that is critically undercapitalized may receive Discount Window credit only during the five-day period that begins on the day it becomes critically undercapitalized. Reserve Banks apply the same rules to depository institutions that are not insured by the FDIC but that are otherwise eligible to borrow at the Discount Window.

Any depository institution subject to one of the above-mentioned limits should maintain liquidity sufficient to keep its needs for Discount Window credit within appropriate bounds. If it appears that liquidity may prove inadequate, the depository institution should consult with its Reserve Bank as far in advance as possible. Such consultations may also include discussions of collateral arrangements needed to ensure the orderly continuation of Federal Reserve payment services.

Seasonal Credit

To become eligible for seasonal credit, a depository institution must establish a seasonal qualification with its Reserve Bank. Eligible institutions are generally limited to those with deposits less than $500 million. A depository institution that anticipates a possible need for seasonal credit is encouraged to contact its Reserve Bank to ascertain its eligibility and make arrangements in advance. Making arrangements does not obligate the institution to borrow.

Critically undercapitalized depository institutions are not eligible for seasonal credit. Undercapitalized or significantly undercapitalized depository institutions may be eligible but only after careful review of their condition and prospects; any lending to such institutions would be subject to statutory limitations established by the FDICIA as discussed earlier under Secondary Credit.

Documentation Requirements for Borrowing

Any depository institution that expects to use the Discount Window should file the necessary lending agreements and corporate resolutions under the terms set forth in the Federal Reserve’s lending agreement, Operating Circular No. 10.

Operating Circular No. 10 documents include:

- Letter of Agreement — indicates a depository institution’s acceptance of the terms and conditions in Operating Circular No. 10

- Authorizing Resolutions for Borrowers — provides a depository institution’s authorization to borrow from and pledge assets to a Reserve Bank

- Official OC-10 Authorization List — a list of individuals or corporate titles of individuals who are authorized to borrow, pledge, or withdraw collateral as specified in the depository institution’s Authorizing Resolutions for Borrowers

- Letter of Agreement to Correspondent Credit and Payment Agreement — required only if the depository institution does not have a Federal Reserve account and a correspondent is selected to receive Discount Window advances and make payments on the depository institution’s behalf

- Certificate — provides the Reserve Bank with all the necessary information to make an effective Uniform Commercial Code-1 financing statement filing against the borrower. Note: This document may not be required; contact the respective Reserve Bank for more information.

- Legal Opinions from Both Foreign and U.S. Outside Counsel — are required from U.S. branches and agencies of foreign branches

Collateral

All extensions of credit must be secured to the satisfaction of the lending Reserve Bank by collateral that is acceptable for that purpose. Most performing or investment-grade assets held by depository institutions are acceptable as collateral. Reserve Banks require a perfected security interest in all collateral pledged to secure Discount Window loans.

Reserve Bank staff can offer guidance on other types of collateral that may be acceptable. The following assets are most commonly pledged to secure Discount Window advances:

- Commercial, industrial, or agricultural loans

- Consumer loans

- Residential and commercial real estate loans

- Corporate bonds and money market instruments

- Obligations of U.S. government agencies and government-sponsored enterprises

- Asset-backed securities

- Collateralized mortgage obligations

- U.S. Treasury obligations

- State or political subdivision obligations

Assets accepted as collateral are assigned a lendable value (market value or an internally modeled fair market value estimate multiplied by standard, published margins), with additional adjustments as deemed appropriate by the Reserve Bank. The financial condition of an institution may be considered when assigning values. Collateral margins are applied to the Federal Reserve’s fair market value estimate and are designed to account for risk characteristics of the pledged asset as well as the volatility of the value of the pledged asset over an estimated liquidation period.

Collateral margins for loans are as follows:

- The Federal Reserve uses reported cash flow characteristics and proxy credit spreads to calculate a fair market value estimate for each pledged loan. When individual loan cash flow characteristics are not available, the Federal Reserve uses general assumptions to estimate the fair market value of the loan pool.

- Margins for loan collateral are likewise based on reported cash flow characteristics. Margins are established based on the historical volatility of risk-free rates and proxy credit spreads, measured over typical liquidation periods.

Collateral margins for securities are as follows:

- Securities are typically valued daily using prices supplied by external vendors. Eligible securities for which a price cannot readily be obtained will be assigned an internally modeled fair market value estimate based on comparable securities, and they will receive the lowest margin for that asset type.

- Margins for securities are assigned based on asset type and duration. Margins are established based on the historical price volatility of each category, measured over typical liquidation periods.

Arrangements for pledging collateral should be reviewed with the Reserve Bank. Securities issued by the U.S. government and most securities issued by U.S. government agencies are held in an automated book-entry records system at the Federal Reserve. Other securities pledged as collateral generally are held by a depository or other agent through a custodian arrangement. Loans (customer notes) pledged as collateral typically are held by a custodian or under a borrower-in-custody arrangement. Physical securities, promissory notes, and other definitive assets may, however, be held on the Reserve Bank’s premises.

Disclosure

In accordance with the provisions of the Dodd–Frank Wall Street Reform and Consumer Protection Act,6 the Federal Reserve changed its practices with respect to disclosure of Discount Window lending information. Effective for Discount Window loans (primary, secondary, and seasonal credit) extended on or after July 21, 2010, the Federal Reserve will publicly disclose the following information, generally about two years after a Discount Window loan is extended to a depository institution:

- The name and identifying details of the depository

institution - The amount borrowed by the depository institution

- The interest rate paid by the depository institution

- Information identifying the types and amounts of collateral pledged in connection with any Discount Window loan. This disclosure requirement does not apply to collateral pledged by depository institutions that do not borrow.

This information will be released quarterly and may be disclosed with less than a two-year lag if the Chair of the Federal Reserve determines that it is in the public’s interest and that the disclosure would not harm the purpose or conduct of the Discount Window.

Conclusion

Since the Federal Reserve System was established in 1913, Discount Window policies and programs have evolved in response to the changing needs of the economy and financial system. The primary credit program serves as a safety valve for ensuring adequate liquidity in the banking system and a backup source of short-term funds for generally sound depository institutions. Most depository institutions qualify for primary credit. Minimal administration of and minimal restrictions on the use of funds make it a reliable short-term backup funding source.

Being prepared to borrow primary credit — similar to access to any backup liquidity facility — enhances a depository institution’s liquidity and eliminates the need to bid for marketplace funds when available funds are tight. Even if a depository institution does not envision using the Discount Window in the ordinary course of events, it is encouraged to execute the required documentation for contingency purposes because the need for Discount Window credit could arise suddenly and unexpectedly.

Depository institutions that may be eligible for the seasonal credit program are encouraged to contact their Reserve Bank to determine eligibility. Institutions that experience fluctuations in deposits and loans frequently qualify for the seasonal lending program. This program provides funding of these seasonal needs so that the institution can carry fewer liquid assets during the rest of the year and make more funds available for local lending.

Depository institutions are encouraged to contact their Reserve Bank to discuss collateral requirements and arrangements before a need to borrow arises.7

Back to top- 1 Much of the statutory framework that governs Discount Window lending is contained in section 10B of the Federal Reserve Act, as amended, available at www.federalreserve.gov/aboutthefed/section10b.htm. The programs and policies that implement the statutory framework are set forth in the Federal Reserve’s Regulation A, available at www.federalreserve.gov/bankinforeg/reglisting.htm.

- 2 Detailed information on the Discount Window is available at www.frbdiscountwindow.org.

- 3 See www.federalreserve.gov/bankinforeg/reglisting.htm for more information about Regulation D.

- 4 CAMELS stands for capital adequacy, asset quality, management, earnings, liquidity, and sensitivity to market risk; SOSA stands for strength of support assessment; and ROCA stands for risk management, operational controls, compliance, and asset quality.

- 5 See www.fdic.gov/regulations/laws/rules/8000-2400.html for more information about the act.

- 6 The text of the Dodd–Frank Wall Street Reform and Consumer Protection Act is available at www.gpo.gov/fdsys/pkg/BILLS-111hr4173enr/pdf/BILLS-111hr4173enr.pdf.

- 7 Discount Window contacts are available at www.frbdiscountwindow.org/Pages/Select-Your-FRB.aspx.