Managing Risks of Commercial Real Estate Concentrations

by Jennifer Burns, Executive Vice President, Supervision, Regulation and Credit, Federal Reserve Bank of Richmond

In the Fifth District of the Federal Reserve System, commercial real estate (CRE) exposures have long been top of mind. As is the case in many regions across our country, CRE lending is and has been a significant strategic focus for many banks. During and right after the Great Recession, CRE exposures on banks’ balance sheets declined because older, nonperforming loans were charged off, and there was a lack of demand for new CRE loans from qualified borrowers. In 2013, exposures began to grow again, concentrations began to build, and trends that signaled an increasing risk appetite for CRE lending began to emerge.

As bank supervisors, we understand that the business models of many community banks1 rely on CRE lending, and we appreciate the benefit that bank lending provides to the economic activity in their communities. Our objective is to help bank leaders develop and implement risk management and capital planning practices that support well-informed decision-making and an ability to balance risk-taking with safety and soundness. Along those lines, in this article, I will share trends that are heightening the supervisory focus on CRE lending practices, including anecdotal risk management observations from examinations. I will highlight potential consequences of high CRE concentrations as evidenced from the last recession and provide some CRE loss rate trends that may offer new insight into risk management considerations. Finally, I will share results and best practices from two horizontal supervisory reviews of banks’ risk management practices completed last year as well as some observations on the current state of capital planning in our District. My hope is that this information helps you as your bank contemplates a strategy for and management of CRE exposures.

Ongoing Surveillance to Spot Trends

Given the prominence of CRE lending in community banking, the Board of Governors of the Federal Reserve System and other federal banking agencies perform ongoing surveillance of individual banks, bank holding companies, and the industry to identify early signs of increasing risks. The agencies look for trends in Call Report data and other regulatory information, including reports of examination and outreach discussions. This information informs our thinking on what risk areas require more attention, where to perform horizontal reviews to gain a broad perspective on the issues, and how to adjust examiner training programs to prepare examiners for conversations with bankers. These trends also help us focus our surveillance, outreach, and training approaches to identify growing risk factors far enough in advance to provide timely and meaningful insights into the banking system.

Focus on Existing Guidance

When the agencies conducted their surveillance activities during 2014 and 2015, they saw trends that indicated that CRE risk appetite and risk levels were rising. In response, at the end of 2015, the Federal Reserve, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency issued the “Interagency Statement on Prudent Risk Management for Commercial Real Estate Lending.”2

This interagency guidance noted “substantial growth in many CRE asset and lending markets, increased competitive pressures, and an easing of CRE underwriting standards.” Importantly, the guidance did not lay out any new risk management requirements or supervisory criteria related to CRE lending. Rather, the guidance reiterated the need for strong risk management practices related to managing CRE credit concentrations and compliance with existing CRE guidance.

Specifically, the agencies reiterated the need for strong risk management practices to comply with Supervision and Regulation (SR) letter 07-1, “Interagency Guidance on Concentrations in Commercial Real Estate.”3 This guidance does not set limits on the size of CRE concentrations but instead highlights strong risk management practices that are necessary for a bank with a high CRE credit concentration. Further, the guidance outlines supervisory screening criteria for concentration levels and a growth percentage for a portion of CRE loans that may potentially expose an institution to significant risk.4

Trends from a Historically High CRE District

Prior to the economic crisis, the Fifth District experienced rapid CRE loan growth. By 2008, the average annual growth in concentrations in total CRE exposure for banks was 36 percent. Two-thirds of the community banks in the Fifth District reported positive CRE concentration growth, and a quarter reported CRE concentration growth greater than 50 percent.

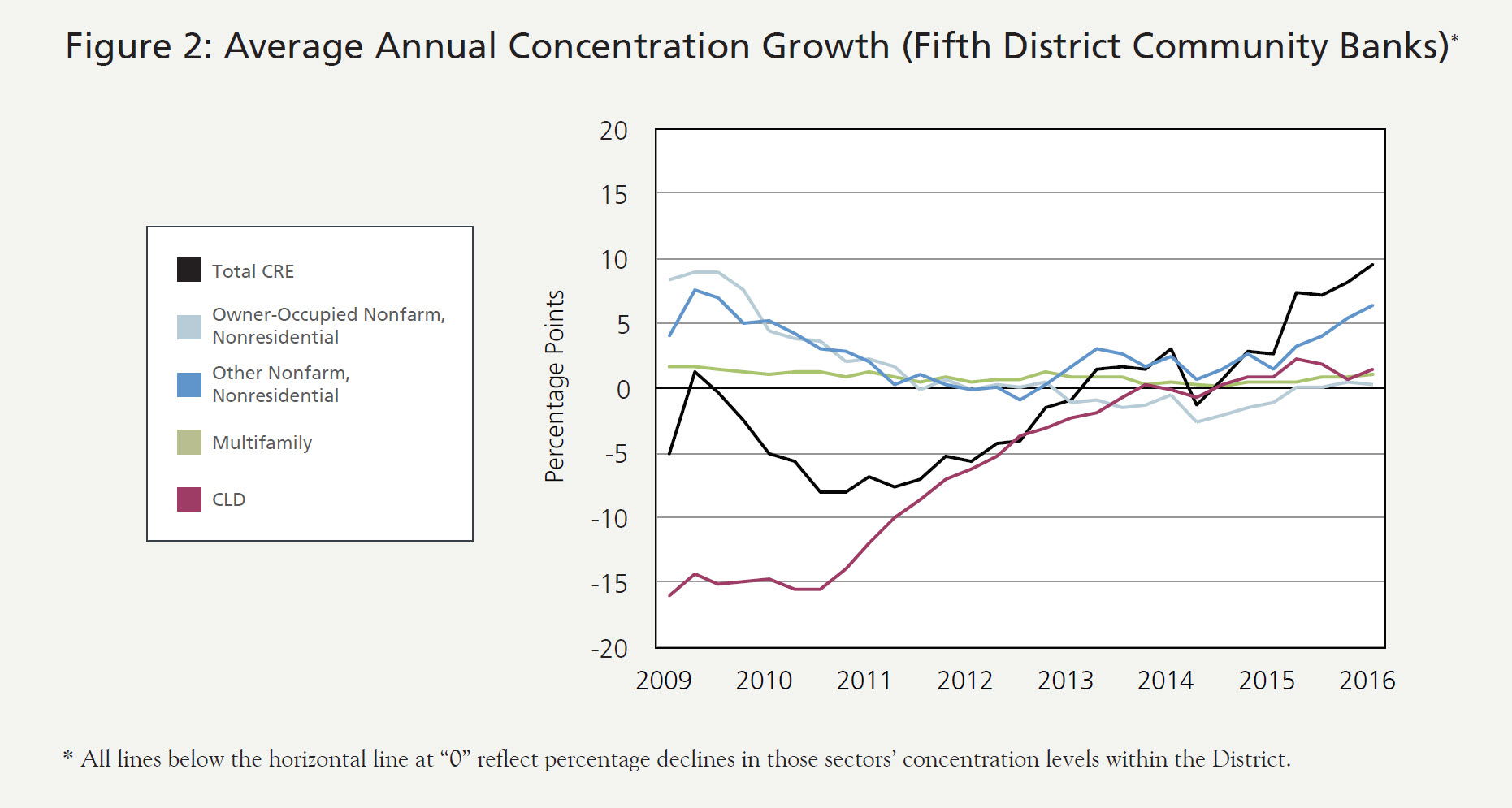

Total CRE growth rates for Fifth District banks dropped rapidly in 2009 and did not become positive again until 2013. By 2016, average annual CRE loan growth for Fifth District community banks had rebounded to about 10 percent, outpacing total average annual loan growth of 9 percent. The construction and land development (CLD) segment grew at an average rate of 14 percent, the highest growth in that sector since 2009.

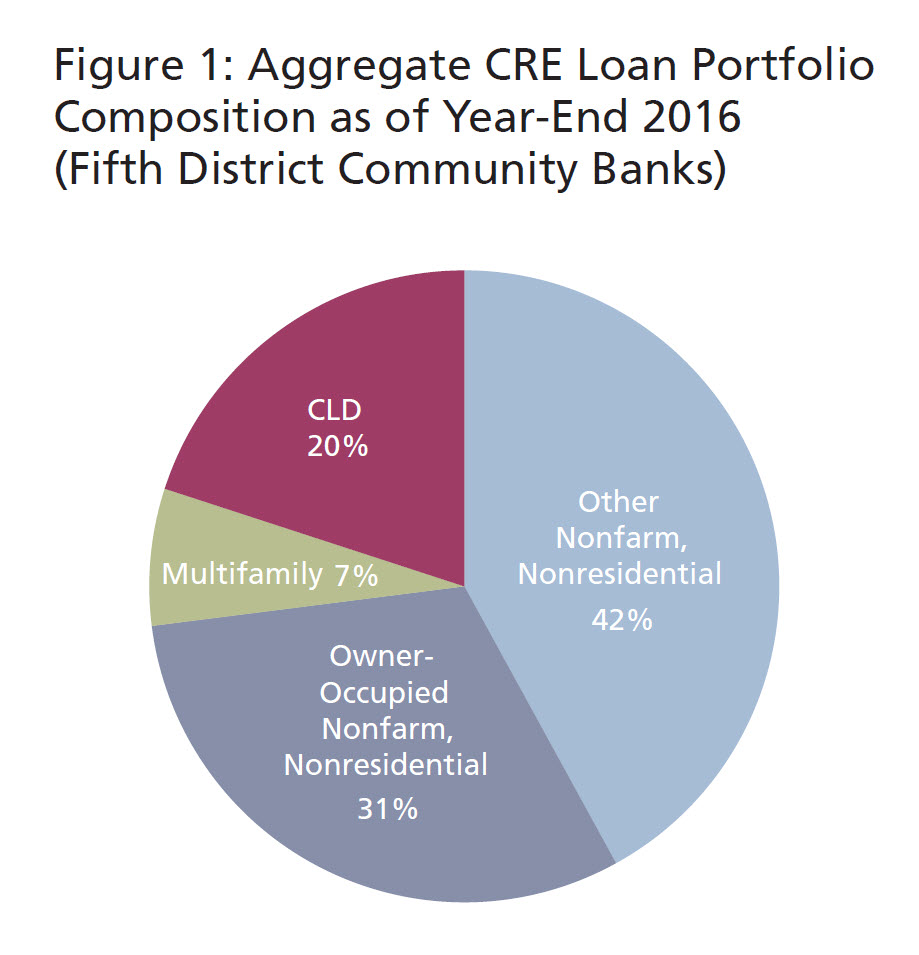

Nationwide, multifamily lending has experienced the highest growth rates since the crisis. However, as depicted in Figure 1, for community banks in the Fifth District, the concentration in that sector is not nearly as large as owner-occupied nonfarm, nonresidential or as other (nonowner-occupied) nonfarm, nonresidential CRE segments. So admittedly, we are more interested in those trends, including positive concentration growth in total CRE loans by community banks, as depicted in Figure 2, and the increasing number of institutions identified as potentially exposed to high CRE concentration risk.

Potential Consequences of High Concentrations

An analysis of community bank losses following the recent financial crisis showed that the concentration criteria outlined in SR letter 07-1 did indeed prove indicative of higher default risk and greater financial stress during the crisis. A 2013 national study validated the relationship between high CRE concentrations and negative impacts to banks during the financial crisis.5 That study found that “during the three-year economic downturn, banks with high CRE concentration levels proved to be far more susceptible to failure” and that “banks that exceeded the supervisory criteria on CRE concentrations tended to experience greater deterioration in condition as assessed by market participants.” In fact, the study found that “among banks that exceeded both supervisory criteria, 23 percent failed during the three-year economic downturn, compared with 0.5 percent of banks for which neither of the criteria was exceeded.”

CRE concentrations at community banks nationwide fell after the financial crisis, owing partly to large losses but also because of a lack of demand and/or sufficiently qualified borrowers to replace CRE loans that were paying down. During this period, we also observed boards of directors opting to add CRE concentration limits or reduce existing limits to levels at or below the criteria outlined in SR letter 07-1. While in December 2008, 52 percent of the Fifth District community banks exceeded one or more of the criteria and 8 percent were nearing the criteria, the percentage of banks that exceeded or were near the CRE limits fell significantly over the next five years. By the end of 2013, the percentage exceeding one or more of the criteria had fallen to 13 percent, while another 11 percent were nearing the criteria. However, starting in 2014, we noticed a slight uptick in those percentages, and, by year-end 2016, 14 percent of the community banks in the Fifth District exceeded the criteria, and another 12 percent were nearing the criteria.

Owner-Occupied: Not as Safe as We Once Thought

Historically, loss rates associated with owner-occupied CRE loans were believed to be much lower than with other types of CRE loans. The rationale was that the cash flow from ongoing operations and activities conducted by the borrower (or an affiliate of the borrower) who owned the property is both the primary payment source of the loan and the livelihood of the borrower. In fact, owner-occupied loss rates were not tracked separately in the Call Report until after the issuance of SR letter 07-1, which excluded supervisory screening criteria for this subset of CRE loans. Similarly, we have rarely encountered banks in which the boards of directors have established concentration limits for the owner-occupied CRE sector. In fact, since the financial crisis, many boards and senior management teams have pursued growth in this segment. In the Fifth District, owner-occupied CRE credit concentrations grew at a higher rate than most other CRE loan segments from 2009 to 2012 and only recently have declined, as growth in other CRE loan segments has started to gain some momentum. As a result, we are seeing owner-occupied CRE credit levels that are quite high in relation to capital.

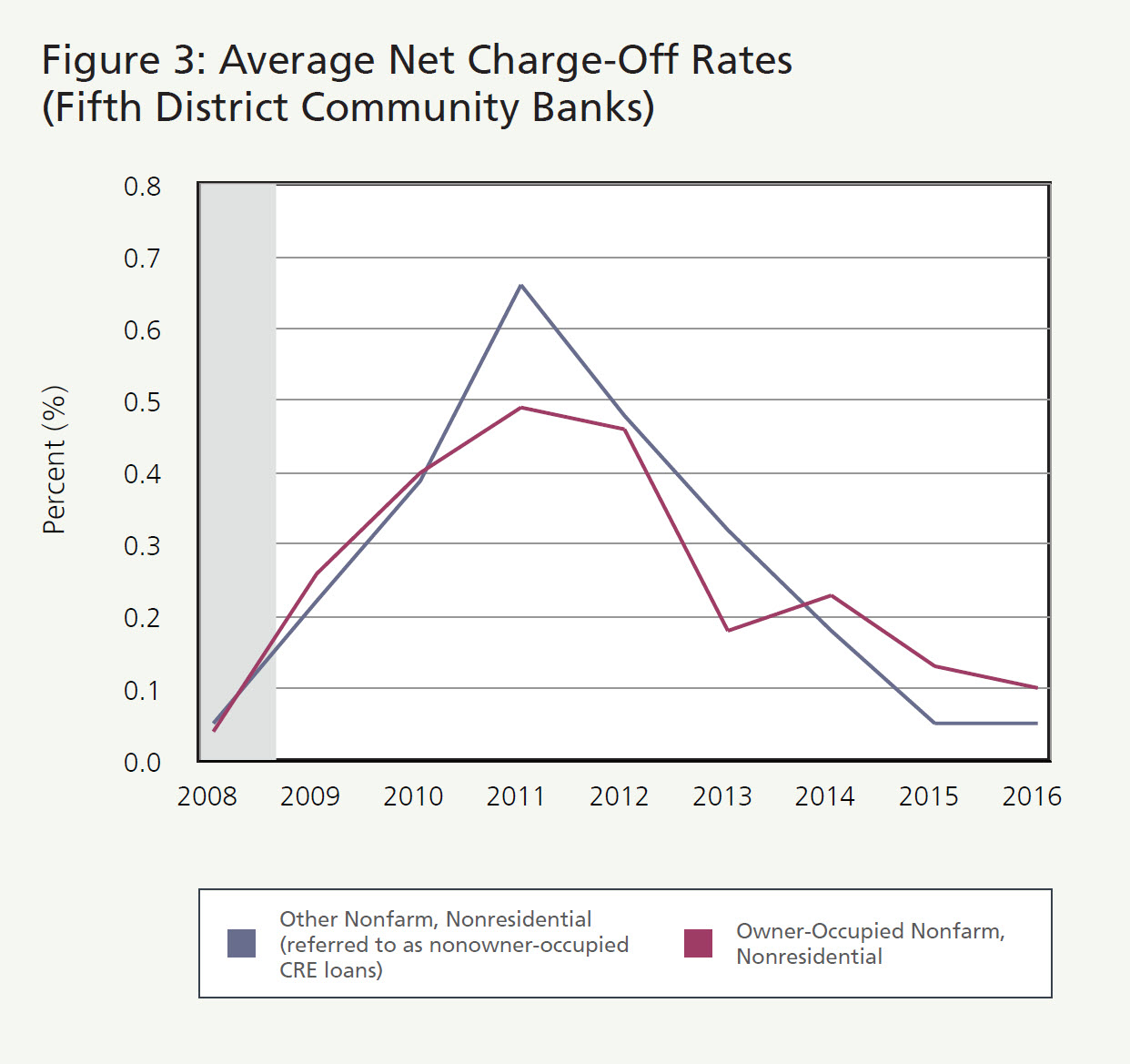

In studying CRE loss patterns for Fifth District banks during the last recession, the pattern that emerged contradicted historically perceived norms. As depicted in Figure 3, the trend line for net charge-off rates of owner-occupied CRE loans was very similar to the trend line for nonowner-occupied charge-off rates for much of the studied period.6 A study on nationwide default rates submitted for the Community Banking in the 21st Century research and policy conference noted similar results.7

The trends in Figure 3, including the unexpected charge-off results for owner-occupied CRE, are a reminder that risks may manifest in unpredictable ways. This underscores the benefits of strong risk management, including consideration of expected and unexpected losses in all portfolios under various stress scenarios.

Insights from CRE Stress Testing

Stress testing of asset concentrations is one way to develop a fuller understanding of the risks and losses that might occur during a downturn. Evaluating the potential effect of stressful conditions on a specific loan portfolio provides bank management and board members with additional information as they determine the level of capital needed to protect the bank from losses in that portfolio.

This is why SR letter 07-1 establishes the expectation that banks with CRE credit concentrations conduct portfolio stress testing. As with most supervisory expectations, the sophistication of the testing should be consistent with the size and complexity of the CRE credit portfolio, including the level and nature of the concentration. What this means exactly can be difficult to tease out, so please take time to discuss this with supervisors at your Reserve Bank.

During 2016, we performed a horizontal review at banks with high CRE loan concentrations, focusing on their stress testing practices. We wanted to compare and contrast the portfolio-level stress testing methodologies that banks use to quantify impacts of changing economic conditions on asset quality, earnings, and capital.

We found that all banks were making efforts to implement sound practices. That said, and given the nascence of stress testing practices, it is not surprising that we found opportunities to make practices more responsive to risks at many of the banks. These reviews have helped us identify a number of best practices:

- Consideration should be given to the CLD portfolio when developing various adverse scenarios and relevant loss rates.8

- Assumptions for inputs such as changes in borrower income and collateral values should be severe enough to provide management with useful information about vulnerabilities. In fact, management may wish to run multiple scenarios to understand the spectrum of potential outcomes. For example, a bank might link scenarios directly to changes in economic conditions, new strategic directions, and shocks to collateral values.

- While a good starting point may be using a bank’s charge-off rates experienced in the last recession, varying these assumptions can provide valuable insight to potential losses in the portfolio should the next recession play out differently.

- After completing a stress test, results should influence both capital and strategic planning. In fact, for maximum benefit, bank management should ensure that stress testing scenarios change over time to stay in sync with the bank’s current strategic plan.

- Finally, it is important to perform independent validation of models to ensure quality results.

Many of the CRE stress tests we see in the Fifth District were developed and implemented after the financial crisis, so they have not been “tested” against an actual downturn. This disadvantage points to the importance of varying your stress test assumptions over time to identify a range of possible losses that your bank may need to absorb. Stress testing should include both high- and low-probability scenarios. The level of sophistication of a bank’s stress testing practices and analysis should be consistent with its size, complexity, and risk characteristics of its CRE loan portfolio. Portfolio stress testing and sensitivity analysis may not necessarily require the use of a sophisticated portfolio model. Stress testing may be as simple as analyzing the potential effect of stressed loss rates on the CRE portfolio, capital, and earnings.Many of the CRE stress tests we see in the Fifth District were developed and implemented after the financial crisis, so they have not been “tested” against an actual downturn. This disadvantage points to the importance of varying your stress test assumptions over time to identify a range of possible losses that your bank may need to absorb. Stress testing should include both high- and low-probability scenarios. The level of sophistication of a bank’s stress testing practices and analysis should be consistent with its size, complexity, and risk characteristics of its CRE loan portfolio. Portfolio stress testing and sensitivity analysis may not necessarily require the use of a sophisticated portfolio model. Stress testing may be as simple as analyzing the potential effect of stressed loss rates on the CRE portfolio, capital, and earnings.

Understanding Current Underwriting Standards

In addition to building our knowledge of stress testing practices, we completed a horizontal review in 2016 to identify trends in banks’ underwriting standards. Anecdotally, bankers stated that underwriting standards were loosening for high-quality borrowers because of intense lender competition. Examiners found that boards were approving loans with concessions to maintain or increase high-quality, in-market relationships. For example, examiners were noting increasing trends in the type and number of underwriting exceptions to internal bank policy guidelines identified in bankers’ management information system reports.

Not surprisingly, the underwriting horizontal review pointed to growth in concessions and terms outside of bank policy limits. Some concession examples included lower equity requirements, extended fixed interest rate periods, longer amortization and interest-only periods, interest-only extensions, lower debt service requirements, higher loan-to-value ratios, and nonrecourse terms for loans in which recourse is generally required by the bank’s policy. For bank supervisors, the trend in concessions is concerning because borrower guarantees and covenants influence when and how borrowers and bankers work together if issues arise.

Throughout the recent financial crisis, the presence of guarantees compelled problem borrowers to work closely with lenders. Borrowers simply did not walk away as they may have done otherwise. Also, in instances when affirmative and negative covenants were included in loan agreements and monitored closely, borrowers and bank management were able to begin working together earlier — and take action sooner — as problems were emerging. These protection mechanisms proved very helpful during the last recession and should prove helpful in future economic downturns.

Most bank boards have approved underwriting policies under the expectation that exceptions will be “one-off” and amount to just a few. However, during intensely competitive periods, boards may want to consider setting limits on prevalent policy exceptions and establishing mitigating factor requirements for some exceptions. Additionally, when there is a significant volume of loans with underwriting exceptions, bank management may wish to incorporate these mitigating factor exception requirements into CRE concentration stress analyses to understand implications for potential loss and, by extension, capital adequacy.

We did not focus on loan pricing concessions in our horizontal review and, thus, have no empirical results to share. Certainly, low market rates breed low loan rates and borrower requests for longer terms. We have heard repeatedly from bankers that they “don’t know how the competition is making any money at the rates and terms they’re offering.” Bank supervisors expect and anticipate that bank management is carefully considering risk when setting pricing, as intense competition on price may lead to underpricing and overextension of credit to weaker borrowers.9

Capital Planning Is Paramount to Managing Risk

In 2013, I wrote a View from the District article on capital planning.10 That article highlighted a message we continue to emphasize today: Risk management, including board attention, cannot fully anticipate and sufficiently reduce high levels of concentration risk. Effective capital planning is paramount to managing risk associated with any asset concentration.

Over the past several years, Fifth District community bankers have significantly improved their banks’ capital planning processes. We see many capital plans that now include a risk assessment process that identifies all necessary elements in setting target capital levels, early warning triggers to alert management to increasing risks, and reasonable action plans with timetables to restore capital to satisfactory levels. Bank boards have also begun to align their banks’ capital planning processes with the strategic planning processes, and some are incorporating the insights from stress tests in setting their capital targets. If you are planning a strategic increase in concentration levels, it is also a good time to review your capital plan to ensure it will cover your projected concentration growth. We welcome these improvements and encourage bank management to take these actions if they have not already done so. Doing so will ensure that capital levels remain commensurate with a bank’s current and projected risk profile.

Balancing the Business

Just as you look for trends within your market to help grow your business, we look for trends to understand how your bank is navigating market changes and maintaining sound operations. CRE lending has begun heating up in the Fifth District, so it is likely happening in other places across the country. As part of that increased activity and competition, we are seeing more and more exceptions in underwriting standards. As I pointed out, recent interagency guidance has not called for any new risk management requirements or supervisory criteria. Instead, it is reinforcing the need for strong risk management practices that align with prior guidance and the size and complexity of a bank’s concentration risk. Through our horizontal stress scenario research, we have seen that regularly running a number of scenarios on high-concentration portfolios — and even ones that are nearing those ratios — can help you improve your capital planning and risk management activities. I look forward to continuing the conversation with bankers in our District regarding some of the trends and best practices we are seeing.

The author would like to thank Sue Werner, James Dail, Hamilton Holloway, and Lauren Ware, all from the Federal Reserve Bank of Richmond, for their contributions to this article.

Editor’s Note — Since this article was penned, Jennifer Burns was appointed by the Board of Governors of the Federal Reserve System as deputy director for the Large Institution Supervision Coordination Committee (LISCC) group where she is playing a significant strategic leadership role providing oversight and guidance to the Board’s Division of Supervision and Regulation and LISCC group, primarily focusing on the supervision of systemically important financial institutions. Jennifer joined the Federal Reserve Bank of Richmond in 1991 and had led the Supervision, Regulation and Credit Department since 2010. Although she remains an integral part of the Federal Reserve, she will be missed at the Richmond Fed for her engagement, intellect, and commitment to a safe and sound banking system.

Back to top- 1 Community banks include state member banks, state nonmember banks, and national banks with assets less than $10 billion.

- 2 See Supervision and Regulation (SR) letter 15-17, “Interagency Statement on Prudent Risk Management for Commercial Real Estate Lending,” available at

www.federalreserve.gov/supervisionreg/srletters/sr1517.htm

.

. - 3 See SR letter 07-1, “Interagency Guidance on Concentrations in Commercial Real Estate,” available at

www.federalreserve.gov/boarddocs/srletters/2007/SR0701.htm

.

. - 4 The criteria for SR letter 07-1 are as follows: (1) total reported loans for construction and land development (CLD) and other land represent 100 percent or more of the institution’s total capital; or (2) total CRE loans (including loans for nonfarm, nonresidential, nonowner-occupied CRE, CLD, other land, and multifamily properties as well as CRE loans not secured by real estate) represent 300 percent or more of an institution’s total capital, and the outstanding balance of the CRE loan portfolio has increased by 50 percent or more during the prior 36 months.

- 5 Keith Friend, Harry Glenos, and Joseph B. Nichols, “An Analysis of the Impact of the Commercial Real Estate Concentration Guidance,” April 2013, available at

www.federalreserve.gov/bankinforeg/cre-20130403a.pdf

.

. - 6 The loss rates for “nonowner-occupied nonfarm nonres” do not include losses for CLD loans or multifamily loans.

- 7 Julie Stackhouse, “Community Bank Research Conference Looks at the Changing Nature of Competition,” Community Banking Connections, First Issue 2016, available at www.cbcfrs.org/articles/2016/i1/view-from-the-district.

- 8 During the recent financial crisis, the average net charge-off rate for CLD loans in Fifth District community banks peaked at 2.8 percent, which was more than double the peak charge-off rates experienced in the other CRE loan segments.

- 9 John Barrickman, New Horizons Financial Group, “Best Practices in Credit Risk Management,” provided to students at the Pacific Coast Graduate School of Banking, 2011.

- 10 Jennifer Burns, “Capital Planning: Not Just for Troubled Times,” Community Banking Connections, Third Quarter 2013, available at www.cbcfrs.org/articles/2013/Q3/Capital-Planning-Not-Just-for-Troubled-Times.