Community Banks and the Revised Regulatory Capital Framework

by Policy Staff at the Board of Governors of the Federal Reserve System

On July 2, 2013, the Federal Reserve Board approved a final regulatory capital rule to help ensure that banking organizations of all sizes and risk profiles maintain strong levels of high-quality capital.1 On July 9, 2013, the Federal Deposit Insurance Corporation’s board of directors approved an interim final rule and the Office of the Comptroller of the Currency approved a final rule identical in substance to the Federal Reserve’s final rule. The rules adopted by the federal banking agencies (revised capital framework) are designed to improve the overall resilience of the U.S. banking system and of individual banking organizations by increasing the quantity and quality of regulatory capital and by addressing shortcomings in regulatory capital requirements that became apparent during the recent financial crisis.

The revised capital framework applies to all banking organizations currently subject to minimum capital requirements, including national banks, state member banks, state nonmember banks, state and federal savings associations, and top-tier bank holding companies (BHCs),2 as well as to certain savings and loan holding companies (SLHCs)3 that were not previously subject to minimum capital requirements (collectively, banking organizations). As with the current regulatory capital framework, the requirements for large, internationally active banking organizations are more complex than those for smaller, less complex banking organizations.4 All banking organizations subject to the revised capital framework, including community banks, will have a significant transition period to meet the new regulatory capital requirements. In particular, community banks will not be subject to the revised capital framework until January 2015.

Similar to what the federal banking agencies highlighted in the "New Capital Rule: Community Bank Guide" issued in July 2013,5 this article notes several changes that were proposed by the agencies in June 2012 (the June 2012 proposal) but that were not adopted in the revised capital framework, in large part to minimize burden on community banks, as well as some of the key changes from the current framework that are most relevant for community banks. Community banks should refer to the revised capital framework itself for a more comprehensive discussion and understanding of applicable requirements, as this article does not provide full coverage.

Key Changes from the June 2012 Proposal

In June 2012, the federal banking agencies issued for comment three notices of proposed rulemaking (NPRs) that would revise and replace the agencies’ capital rules.6 The agencies received more than 2,500 comments on the proposed changes, with the majority of the comments submitted by community banks expressing concern about certain aspects of the NPRs that they believed would have imposed undue burden. Community banks were particularly concerned about three elements of the proposals: the elimination of the filter for most components of accumulated other comprehensive income (AOCI), the phase-out of trust preferred securities (TruPS) from tier 1 capital, and the proposed treatment for residential mortgage exposures. The agencies carefully considered all the comments received and, as a result, made a number of changes prior to adopting the revised capital framework to reduce the number of and simplify the modifications of the current general risk-based capital rules that apply to community banks.

AOCI Filter

In contrast to the current treatment, the June 2012 proposal would have required all banking organizations to reflect most AOCI components, including unrealized gains and losses on available-for-sale securities, in regulatory capital. A number of commenters said that this proposed change would result in significant regulatory capital volatility due to, for example, fluctuations in benchmark interest rates, which could be especially difficult for community banks to manage. Under the revised capital framework, nonadvanced approaches banking organizations (including community banks) may elect to continue with the current AOCI treatment and exclude most of the AOCI components from regulatory capital (the AOCI opt-out election). The AOCI opt-out election must be made on a banking organization’s first Call Report, FR Y-9C, or FR Y-9SP, as applicable, filed after January 1, 2015. The agencies have proposed changes to the reporting forms, as noted below in the "Implementation" section, that would facilitate this election.

Nonqualifying Capital Instruments and Tier 1 Capital

The June 2012 proposal would have required all banking organizations to phase out TruPS and cumulative perpetual preferred stock from tier 1 capital. A number of commenters asserted that TruPS had been an effective source of capital for small banking organizations that may have a more limited access to capital markets than larger organizations. In addition, commenters referred to section 171 of the Dodd-Frank Act, which would permit smaller banking organizations (including banking organizations with total consolidated assets of less than $15 billion as of December 31, 2009) to include in tier 1 capital TruPS and certain other capital instruments that were issued prior to May 19, 2010.7

In light of the concerns raised, the revised capital framework permits depository institution holding companies with less than $15 billion in total consolidated assets as of December 31, 2009, (and banking organizations that were mutual holding companies as of May 19, 2010) to continue including capital instruments that were issued by these institutions prior to May 19, 2010, and that are currently included in tier 1 capital (such as TruPS and cumulative perpetual preferred stock), subject to limits. Specifically, similar to the current general risk-based capital requirements, these instruments are limited to 25 percent of tier 1 capital elements, excluding any nonqualifying capital instruments and after all regulatory capital deductions and adjustments are applied to tier 1 capital.

Residential Mortgages

Under the June 2012 proposal, a bank would divide its residential mortgage exposures into one of two categories based on various risk characteristics and then assign a risk weight based on the exposure’s loan-to-value ratio. Commenters raised concerns that the proposed changes would be burdensome for banks and, in light of other mortgage-related rules, could reduce credit availability by discouraging community banks from engaging in mortgage lending. In light of these comments, and the importance of community banks’ lending in local economies, the agencies retained the current treatment for residential mortgage exposures.

Specifically, the revised capital framework assigns a 50 percent risk weight to first-lien residential mortgage exposures that are prudently underwritten and that are not past due, reported as nonaccrual, or restructured. All other one- to four-family residential mortgage loans are assigned a 100 percent risk weight. In addition, the revised capital framework does not change the current exclusions from the definition of credit-enhancing representations and warranties.

Major Changes from the Current General Risk-Based Capital Rules

As noted above, the revised capital framework includes several regulatory capital changes aimed at improving the resilience of the overall U.S. banking system. The revised framework also includes a more risk-sensitive treatment for certain exposures; however, for many exposures typically held by community banks, the revised capital framework maintains the current treatment.

Higher Quantity and Quality of Capital

The revised capital framework is designed to ensure that all banking organizations hold higher amounts of high-quality regulatory capital that is available to absorb losses on a going-concern basis. The revised framework emphasizes the importance of common equity tier 1 capital, which is the highest-quality, most loss-absorbing form of capital. It will primarily be composed of common stock and retained earnings, and the vast majority of regulatory deductions will come from common equity tier 1 capital (as opposed to tier 1 capital, as is the case under the current general risk-based capital rules).

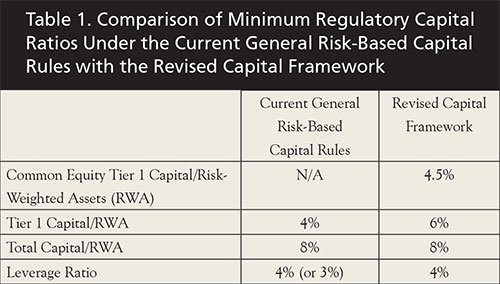

Under the revised capital framework, banking organizations are subject to a new minimum risk-based capital ratio of common equity tier 1 capital to risk-weighted assets of 4.5 percent. The revised capital framework also raises the minimum risk-based capital ratio of tier 1 capital to risk-weighted assets from 4 percent to 6 percent, and it applies the same minimum leverage ratio of 4 percent for all banking organizations (see Table 1).

The revised capital framework incorporates other changes to the general risk-based capital rules that are designed to improve the quantity and quality of regulatory capital. For example, the revised framework implements stricter eligibility criteria for regulatory capital instruments, strictly limits the amount and type of minority interest that can be included in regulatory capital, and imposes individual and collective threshold deductions for mortgage-servicing assets, deferred tax assets arising from temporary differences that cannot be realized from net operating loss carrybacks, and significant investments in the capital of unconsolidated financial institutions in the form of common stock.

In addition, the revised capital framework introduces a capital conservation buffer that is designed to provide incentives for all banking organizations to conserve capital during benign economic periods so that they are prepared to withstand severe stress events while still remaining above the minimum capital levels and continuing to lend to creditworthy households and businesses. More specifically, banking organizations need to hold an additional amount of common equity tier 1 capital (on top of the minimum risk-based capital requirements) in an amount greater than 2.5 percent of risk-weighted assets to avoid limitations on capital distributions and discretionary bonus payments to executive officers. The capital conservation buffer applies beginning on January 1, 2016.

Prompt Corrective Action

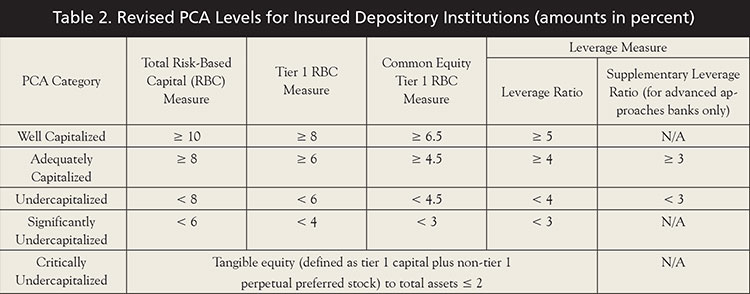

The revised capital framework includes revisions to the prompt corrective action (PCA) framework for insured depository institutions. These revisions incorporate the new minimum regulatory capital requirements into the PCA framework, while maintaining its general structure.8 Specifically, the revised PCA framework incorporates the new common equity tier 1 capital ratio; increases the current PCA thresholds for the tier 1 capital ratio; revises the definition of tangible common equity; and, for advanced approaches banks only, incorporates the supplementary leverage ratio (see Table 2).

Revised Risk-Weighting Methodologies for Certain Exposures

The revised capital framework improves the risk-sensitivity of the general risk-based capital rules by addressing the shortcomings of certain risk weights that became apparent during the recent financial crisis. Specifically, loans that are past due or on nonaccrual, as well as high-volatility commercial real estate (HVCRE) exposures, are risk weighted at 150 percent. HVCRE exposures include certain acquisition, development, or construction loans and represent a subset of commercial real estate exposures. Commercial real estate loans that do not meet the definition of an HVCRE exposure retain their current risk weight.

The revised capital framework also raises from 0 percent to 20 percent the credit conversion factor for off-balance-sheet short-term commitments that are not unconditionally cancelable by a banking organization. This change is designed to better reflect risk and differentiate these commitments from those that are unconditionally cancelable. Risk weights for foreign sovereign, bank, and public-sector exposures, as well as for securities firms and equity exposures, are also revised.

In addition, the revised capital framework changes the treatment of securitization exposures consistent with section 939A of the Dodd-Frank Act, which prohibits using references to, and reliance on, external credit ratings in the regulations of federal agencies and directs agencies to use alternative standards of creditworthiness.9 The revised framework replaces the ratings-based approach, which uses credit ratings to assign risk weights, with the simplified supervisory formula approach to determine the appropriate risk weights for securitization exposures. Alternatively, banking organizations may use the existing gross-up approach, which assigns risk-weighted asset amounts based on the full amount of the credit-enhanced assets for which the banking organization directly or indirectly assumes credit risk, or assign securitization exposures a 1,250 percent risk weight.

Implementation

The revised capital framework provides a phase-in period for smaller, less complex banking organizations that will not begin until January 2015. After considering comments on the June 2012 proposal, the federal banking agencies reconsidered certain elements of the proposed rule and, in the end, adopted a framework that strengthens the resilience of the financial system while minimizing the burden on community banks.

In August 2013, the agencies proposed modifications to the current regulatory capital reporting forms to implement the revised capital framework. The reporting changes would come into effect for community banks starting with the first applicable regulatory reporting form(s) in 2015.10 In the near future, the agencies expect to propose additional revisions to the reporting forms pertaining to risk-weighted assets that would also take effect in 2015. Community banks are encouraged to comment on the proposed reporting changes and should contact their Reserve Bank or primary federal supervisor, as appropriate, with any questions on the revised capital framework.

Back to top

-

1

See "Federal Reserve Board approves final rule to help ensure banks maintain strong capital positions," Board of Governors of the Federal Reserve System

press release, July 2, 2013, available at www.federalreserve.gov/newsevents/press/bcreg/20130702a.htm.

- 2 The revised capital framework applies to BHCs that are not subject to the Federal Reserve Board's Small BHC Policy Statement (typically those with total consolidated assets of less than $500 million). See 12 CFR 225, Appendix C (Small Bank Holding Company Policy Statement).

- 3 At this time, the revised capital framework does not apply to SLHCs with significant commercial or insurance underwriting activities (as specified in the revised capital framework). The Federal Reserve Board will take additional time to evaluate the appropriate regulatory capital framework for these entities.

- 4 For example, banking organizations with more than $250 billion in total consolidated assets or $10 billion in on-balance-sheet foreign exposures (advanced approaches banking organizations) are subject to the advanced approaches risk-based capital rule and, under the revised capital framework, an additional minimum supplementary leverage ratio and a countercyclical capital buffer.

-

5

See www.federalreserve.gov/bankinforeg/basel/files/capital_rule_community_bank_guide_20130709.pdf.

-

6

The press release announcing the June 2012 proposal and the attachments (Basel III NPR, Advanced Approaches and Market Risk NPR, and Standardized Approach

NPR) are available at www.federalreserve.gov/newsevents/press/bcreg/20120612a.htm.

See "Agencies Seek Comment on Regulatory Capital Rules and Finalize

Market Risk Rule," Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the

Currency press release, June 12, 2012.

See "Agencies Seek Comment on Regulatory Capital Rules and Finalize

Market Risk Rule," Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the

Currency press release, June 12, 2012.

- 7 "Dodd-Frank Act" refers to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Pub. L. 111-203, 124 Stat. 1376).

- 8 The revised capital framework does not change the existing constraints on banks' activities within the PCA categories.

- 9 A related topic was discussed in the Community Banking Connections article "Investing in Securities Without Relying on External Credit Ratings." The article is available at www.cbcfrs.org/articles/2013/Q2/Investing-in-Securities-Without-Relying-on-External-Credit-Ratings.

-

10

See the proposed regulatory capital reporting forms (Call Report (FFIEC

031/041), RC-R; FR Y-9C, HC-R, and FR Y-9SP, SC-R), available at www.federalreserve.gov/apps/reportforms/review.aspx.