Some Thoughts on Community Banking: A Conversation with Chair Janet Yellen

Throughout her career at the Federal Reserve, Janet Yellen has recognized the important role that community banks play in the U.S. economy. Community Banking Connections Advisory Board members sat down with Chair Yellen to get further insight from her on the benefits of community banking and the various challenges that these institutions face today.

Advantages and Challenges Facing Community Banks

![]() Why are community banks important to the economy?

Why are community banks important to the economy?

![]() I believe a healthy financial system relies on institutions of different sizes performing a variety of functions and serving a range of customer needs. Community banks1 play an important role in our national economy. For one thing, they help to reduce the number of underbanked customers, especially in rural areas that may not be served by larger banking organizations. Community banks also help to keep their local communities vibrant and growing by providing financial services to local consumers and businesses.

I believe a healthy financial system relies on institutions of different sizes performing a variety of functions and serving a range of customer needs. Community banks1 play an important role in our national economy. For one thing, they help to reduce the number of underbanked customers, especially in rural areas that may not be served by larger banking organizations. Community banks also help to keep their local communities vibrant and growing by providing financial services to local consumers and businesses.

Community banks understand their customers’ needs and local economic conditions, and, as a result, they sometimes can be more responsive to local lending requests than large multistate banks. Because they know their customers so well, community banks often will consider a broader range of factors than larger banks when making lending decisions, and they may also be willing to underwrite loans to creditworthy customers that large banking organizations may be unwilling to make. When you consider that there were more than 5,500 community banks in the United States as of year-end 2014, you can appreciate their collective reach and the important role that they play in the economy.

![]() What are the common characteristics of community banks that failed as opposed to those that managed to thrive throughout the crisis?

What are the common characteristics of community banks that failed as opposed to those that managed to thrive throughout the crisis?

![]() When I was the president of the Federal Reserve Bank of San Francisco, I saw firsthand the strain that the financial crisis had on community banks, and I observed that many bank failures could be traced to a bank’s risk management practices not keeping pace with the expansion of its real estate lending activity. Many community banks that failed had high concentrations in commercial real estate, especially construction and development lending in markets that experienced significant decreases in real estate values. These concentrations became especially problematic at banks that did not have sufficient capital to absorb losses.

When I was the president of the Federal Reserve Bank of San Francisco, I saw firsthand the strain that the financial crisis had on community banks, and I observed that many bank failures could be traced to a bank’s risk management practices not keeping pace with the expansion of its real estate lending activity. Many community banks that failed had high concentrations in commercial real estate, especially construction and development lending in markets that experienced significant decreases in real estate values. These concentrations became especially problematic at banks that did not have sufficient capital to absorb losses.

On the other hand, banks that managed to thrive throughout the crisis had what I consider to be a traditional business model — in other words, local deposit-taking and conservative lending — along with strong corporate governance, robust risk management frameworks, careful growth plans, and strategies that supported a reasonably well-diversified balance sheet. Concentrations of any type of loans add risk and require strong risk management. Even with strong risk management in place, however, healthy banks were not immune from losses; banks that had capital positions commensurate with their risk exposures were better able to absorb these losses and continue serving customers throughout the crisis.

![]() What are some of the heightened risks that community banks are currently facing?

What are some of the heightened risks that community banks are currently facing?

![]() Although community banks provide a wide range of services for their customers, their primary activities revolve around deposit-taking and lending. Risks at community banks primarily arise from their lending activity, in the form of credit risk, interest rate risk, or concentration risk, rather than from the types of trading, market-making, and investment banking activities associated with the largest banks.

Although community banks provide a wide range of services for their customers, their primary activities revolve around deposit-taking and lending. Risks at community banks primarily arise from their lending activity, in the form of credit risk, interest rate risk, or concentration risk, rather than from the types of trading, market-making, and investment banking activities associated with the largest banks.

While credit risk concentrations have historically contributed to problems at community banks, interest rate risk is also something that we are working with community banks to monitor. Our examiners have been reviewing whether banks are able to manage risks arising from future changes in rates. Fortunately, our sense so far has been that the vast majority of community banks are paying adequate attention to interest rate risk management, although we will of course be keeping a close eye on this risk going forward.

Another growing risk facing banks of all sizes is cybersecurity. Banks have not only suffered direct financial losses from cyberattacks, but they also must absorb costs associated with customer data breaches. As community banks are expanding their online banking services to meet customer needs and compete with large banking organizations, community banks need to stay informed of cyberthreats and implement strong controls to protect their operations against these attacks.

In response to the increasing frequency and sophistication of cyberattacks against banks, the Federal Financial Institutions Examination Council (FFIEC) in June 2013 created the Cybersecurity and Critical Infrastructure Working Group to address policies related to cybersecurity and critical infrastructure security.2 We, along with our colleagues at the other FFIEC agencies, are devoting considerable resources to address cyber-related issues. In addition, we continually communicate and coordinate with the law enforcement and intelligence communities, as well as financial industry associations, on cybersecurity matters.

Federal Reserve Efforts to Solicit the Views of Community Banks

![]() How does the Federal Reserve solicit the views of community bankers?

How does the Federal Reserve solicit the views of community bankers?

![]() I consider it very important for the Federal Reserve to pay close attention to the issues and concerns facing community banks. That’s why we have so many different ways to engage with and hear from community bankers. The leadership and staff at the 12 Federal Reserve Banks are in regular contact with community bankers in their districts. While I and my colleagues on the Board of Governors always appreciate the opportunity to travel to different parts of the country, the Reserve Banks in many ways serve as our eyes and ears, not only regarding supervisory issues, but also local economic trends. Reserve Banks host forums and other events throughout the year to meet with bankers to get their perspectives on banking issues, and Reserve Bank staff often share what they hear at these events with Board staff in Washington, D.C. In addition, I and other Board members meet regularly with community bankers.

I consider it very important for the Federal Reserve to pay close attention to the issues and concerns facing community banks. That’s why we have so many different ways to engage with and hear from community bankers. The leadership and staff at the 12 Federal Reserve Banks are in regular contact with community bankers in their districts. While I and my colleagues on the Board of Governors always appreciate the opportunity to travel to different parts of the country, the Reserve Banks in many ways serve as our eyes and ears, not only regarding supervisory issues, but also local economic trends. Reserve Banks host forums and other events throughout the year to meet with bankers to get their perspectives on banking issues, and Reserve Bank staff often share what they hear at these events with Board staff in Washington, D.C. In addition, I and other Board members meet regularly with community bankers.

We also have more formal mechanisms for hearing the views of bankers. For instance, the Federal Reserve formed the Community Depository Institutions Advisory Council (CDIAC) in 2010 to provide input to the Board of Governors on the economy, lending conditions, and other issues of interest to community depository institutions.3 Representatives from banks, thrift institutions, and credit unions are selected to serve on local advisory councils at each of the Federal Reserve Banks. One member from each of the Reserve Bank councils is selected to serve on the national CDIAC, which meets twice a year with the Board of Governors in Washington, D.C., to discuss topics of interest to community depository institutions. I find these meetings to be interesting and informative.

In addition to the efforts already discussed, the Federal Reserve always welcomes the views of community bankers on proposed regulations issued for comment in the Federal Register. Comments from community bankers help us to scale rules and policies to appropriately reflect the risks at smaller institutions and to assess implementation complexity and cost.

![]() Could you please describe the Economic Growth and Regulatory Paperwork Reduction Act (EGRPRA) review process?

Could you please describe the Economic Growth and Regulatory Paperwork Reduction Act (EGRPRA) review process?

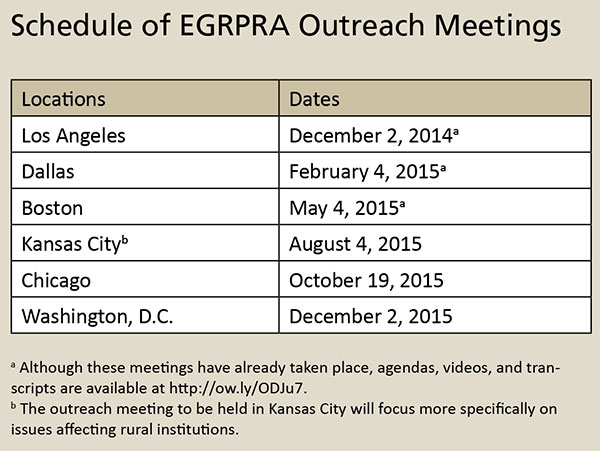

![]() In accordance with the EGRPRA, the Federal Reserve, the other federal bank regulatory agencies,4 and the FFIEC have launched a review to identify banking regulations that are outdated, unnecessary, or unduly burdensome. The agencies recently expanded the review to include regulations that are relatively new, including rules adopted or proposed in the implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act).5 We have issued three Federal Register notices seeking comments on our regulations thus far,6 and we will publish one additional Federal Register notice over the next year. The agencies will submit a report to Congress that summarizes any significant issues raised by the comments and the relative merits of such issues.

In accordance with the EGRPRA, the Federal Reserve, the other federal bank regulatory agencies,4 and the FFIEC have launched a review to identify banking regulations that are outdated, unnecessary, or unduly burdensome. The agencies recently expanded the review to include regulations that are relatively new, including rules adopted or proposed in the implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act).5 We have issued three Federal Register notices seeking comments on our regulations thus far,6 and we will publish one additional Federal Register notice over the next year. The agencies will submit a report to Congress that summarizes any significant issues raised by the comments and the relative merits of such issues.

The agencies also have begun a series of outreach meetings with bankers, consumer groups, and other interested parties to discuss the review.7 Community bankers are encouraged to express their views on the regulations under review in a comment letter or at one of the outreach meetings.

I can certainly say, though, that the comments from the industry, consumer groups, and others have been very informative and will help us and our colleagues at the other agencies to assess regulatory burden. We have received comments on a variety of issues, and I expect we will receive many more comments in the coming months. Since we are only midway through the EGRPRA process, it is too soon to form any definitive conclusions, but several themes have arisen so far in the process.

One recurring theme in the comments has been the question of whether the agencies could reevaluate regulations that may constrain the lending activities of community banks. For example, community bankers have asked the agencies to consider increasing the dollar threshold in their appraisal regulations for transactions below which an appraisal would not be required. This change may provide relief to community bankers by allowing them to use a less-formal valuation of collateral for a larger number of loans, especially in rural areas where it can be difficult to find an appraiser with knowledge about the local market at a reasonable fee.

A number of community banks have also suggested reducing the burden from required quarterly reporting of the Consolidated Reports of Condition and Income (commonly called the Call Report). Working through the FFIEC, the Federal Reserve is considering ways we could perhaps respond to industry concerns about Call Report filing requirements and assessing the potential impact of collecting less data from banks.

The agencies will consider all the feedback gathered at these meetings and in written comments in the ongoing assessment of our regulations. In some cases, legislative action to update the federal statutes upon which the agencies base our regulations may be needed to implement the suggested changes.

Federal Reserve Efforts to Address Community Bankers’ Concerns

![]() What steps have been taken by the Federal Reserve to address concerns raised by community bankers about the burden of new regulations and supervisory requirements?

What steps have been taken by the Federal Reserve to address concerns raised by community bankers about the burden of new regulations and supervisory requirements?

![]() Community bankers often raise concerns about the time demands of the examination process and the higher expenses that can arise from new supervisory regulations and policies. In that regard, we are taking steps to tailor and improve our examination processes to be more efficient for lower-risk banks. For example, some aspects of the loan review process can be conducted offsite for banks that maintain certain electronic loan records. This reduces the burden on many community banks and often reduces the time spent onsite by Federal Reserve examiners.

Community bankers often raise concerns about the time demands of the examination process and the higher expenses that can arise from new supervisory regulations and policies. In that regard, we are taking steps to tailor and improve our examination processes to be more efficient for lower-risk banks. For example, some aspects of the loan review process can be conducted offsite for banks that maintain certain electronic loan records. This reduces the burden on many community banks and often reduces the time spent onsite by Federal Reserve examiners.

With respect to supervisory regulations and policies, we recognize that the cost of compliance can have a disproportionate impact on smaller banks, as they have fewer staff members available to help comply with additional regulations. To address this, we work within the requirements of the law to draft rules that are not unduly burdensome for community banks to implement. This is evident in many of the Federal Reserve regulations implementing the Dodd-Frank Act, where the most stringent requirements apply only to the largest and most complex banking organizations and not to community banks.

The Board also relies on its Subcommittee on Smaller Regional and Community Banking of the Committee on Bank Supervision to review proposed supervisory policies and weigh the potential effect on community banks.8 This subcommittee oversees the supervision of community and regional banks and reviews proposed supervisory policies to help ensure that they are appropriate for, and tailored to, community banks.

As we develop supervisory policies and examination practices, we are very mindful of community bankers’ concerns that new requirements for large banking organizations could inadvertently be viewed as “best practices” for the financial sector that trickle down to community banks in a way that is inappropriate for the risks that they face. To address this concern, we have been enhancing our communications with and training for examination staff about expectations for community banks versus large banking organizations to ensure that expectations are calibrated appropriately. When our examiners are trained effectively and kept informed of newly issued policies in a timely manner, they are better equipped to understand the supervisory goals of regulations and guidance and to provide appropriate feedback to bankers.

![]() Can you share any examples of how the Federal Reserve has modified supervisory policy to provide regulatory relief to community banks?

Can you share any examples of how the Federal Reserve has modified supervisory policy to provide regulatory relief to community banks?

![]() In April of this year, the Federal Reserve Board approved a final rule that increased the asset threshold of its Small Bank Holding Company Policy Statement from $500 million to $1 billion and applied the policy statement to savings and loan holding companies.9 The policy statement facilitates the transfer of ownership of small community banks and savings associations by allowing their holding companies to operate with higher levels of debt than would normally be permitted. Holding companies that qualify for the policy statement are also excluded from consolidated capital requirements, though their depository institution subsidiaries continue to be subject to minimum capital requirements. All qualifying firms must still meet certain qualitative requirements, including those pertaining to nonbanking activities, off-balance sheet activities, and publicly registered debt and equity.

In April of this year, the Federal Reserve Board approved a final rule that increased the asset threshold of its Small Bank Holding Company Policy Statement from $500 million to $1 billion and applied the policy statement to savings and loan holding companies.9 The policy statement facilitates the transfer of ownership of small community banks and savings associations by allowing their holding companies to operate with higher levels of debt than would normally be permitted. Holding companies that qualify for the policy statement are also excluded from consolidated capital requirements, though their depository institution subsidiaries continue to be subject to minimum capital requirements. All qualifying firms must still meet certain qualitative requirements, including those pertaining to nonbanking activities, off-balance sheet activities, and publicly registered debt and equity.

Concurrently, the Board reduced the regulatory reporting burden for bank holding companies and savings and loan holding companies with less than $1 billion in total consolidated assets that meet the qualitative requirements of the policy statement.10 Before we made this change, companies subject to the policy statement reported 65 pages of data items; they now need to report only eight pages of data items.

Federal Reserve Resources Available to Community Banks

![]() What tools does the Federal Reserve provide to assist community banks?

What tools does the Federal Reserve provide to assist community banks?

![]() In addition to this publication, the Federal Reserve offers various free resources to community bankers, including online training for bank directors and conference calls in which Federal Reserve staff members speak with bankers on current banking issues. I encourage community bankers to discuss their questions with their local Reserve Bank and, if they have issues or concerns, to work with our staff to try to resolve these issues before the examination review process begins. Ongoing dialogue between the Federal Reserve and community banking institutions is quite important. And I welcome hearing from community bankers from across the country, since I believe we share the common goal of a safe and sound banking system and a strong economy.

In addition to this publication, the Federal Reserve offers various free resources to community bankers, including online training for bank directors and conference calls in which Federal Reserve staff members speak with bankers on current banking issues. I encourage community bankers to discuss their questions with their local Reserve Bank and, if they have issues or concerns, to work with our staff to try to resolve these issues before the examination review process begins. Ongoing dialogue between the Federal Reserve and community banking institutions is quite important. And I welcome hearing from community bankers from across the country, since I believe we share the common goal of a safe and sound banking system and a strong economy.

Community Bank Resources

Ask the Fed consists of periodic conference calls for bankers that feature Federal Reserve experts and guest speakers discussing top banking issues, with time at the end for questions and comments. For further information, visit www.askthefed.org. ![]()

Basics for Bank Directors, now in its fifth edition, is a reference guide for bank directors. This publication details the processes and procedures for promoting the stability, growth, and success of banks. For more information, visit www.kansascityfed.org/Publicat/BasicsforBankDirectors/BasicsforBankDirectors.pdf. ![]()

![]()

Bank Director’s Desktop provides online training for bank directors that introduces corporate governance and director duties and responsibilities; covers basic bank financial analysis; and discusses the sources, control, and monitoring of portfolio risks, including credit, liquidity, and market risks. For more information, visit www.bankdirectorsdesktop.org/. ![]()

Community Banking Connections is a quarterly publication, available in print and online, dedicated to addressing issues that community banks currently face, providing resources on key supervisory policies, highlighting new regulations, and offering perspectives from bank examiners and other Federal Reserve staff. For more information, visit www.cbcfrs.org.

Consumer Compliance Outlook is a quarterly Federal Reserve System publication dedicated to consumer compliance issues. For further information, visit www.consumercomplianceoutlook.org/. ![]()

FedLinks consists of a series of single-topic bulletins prepared specifically for community bankers that highlight key elements of a supervisory topic to improve clarity and understanding about the topic and examiner expectations for applying related supervisory guidance. For further information, visit www.cbcfrs.org/fedlinks.

Outlook Live is a popular webinar series that delves deeper into consumer compliance topics of interest. For further information, visit www.consumercomplianceoutlook.org/outlook-live/. ![]()

Partnership for Progress is a national outreach effort to help minority-owned institutions confront unique business model challenges; cultivate safe banking practices; and compete more effectively in the marketplace through a combination of one-on-one guidance, workshops, and an extensive interactive web-based resource and information center. For more information, visit www.fedpartnership.gov/. ![]()

Back to top

- 1 For supervisory purposes, the Federal Reserve uses the term “community banking organization” to describe a state member bank and/or holding company with $10 billion or less in total consolidated assets.

- 2 See www.ffiec.gov/cybersecurity.htm.

- 3 See www.federalreserve.gov/aboutthefed/cdiac.htm.

- 4 The other federal bank regulatory agencies are the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC).

- 5 The review encompasses consumer regulations that were not transferred to the Consumer Financial Protection Bureau but remained with the banking agencies.

- 6 Board of Governors of the Federal Reserve System, FDIC, and OCC, “Federal Bank Regulatory Agencies Seek Comment on Interagency Effort to Reduce Regulatory Burden,” press releases, June 4, 2014, February 20, 2015, and May 29, 2015, available at www.federalreserve.gov/newsevents/press/bcreg/20140604a.htm

, www.federalreserve.gov/newsevents/press/bcreg/20150220a.htm

, www.federalreserve.gov/newsevents/press/bcreg/20150220a.htm  , and www.federalreserve.gov/newsevents/press/other/20150529b.htm

, and www.federalreserve.gov/newsevents/press/other/20150529b.htm  , respectively.

, respectively. - 7 See the FFIEC’s EGRPRA website at http://egrpra.ffiec.gov/

for more information.

for more information. - 8 See www.federalreserve.gov/aboutthefed/bios/board/default.htm.

- 9 See www.federalreserve.gov/newsevents/press/bcreg/20150409a.htm.

- 10 Specifically, the Board eliminated quarterly and more complex consolidated financial reporting requirements for these institutions (FR Y-9C) and instead now requires parent-only financial statements (FR Y-9SP) semiannually.